Form 911 Instructions

What is Form 911? How and where to fill out Form 911? Read this article to give answers to these questions and more.

Contents

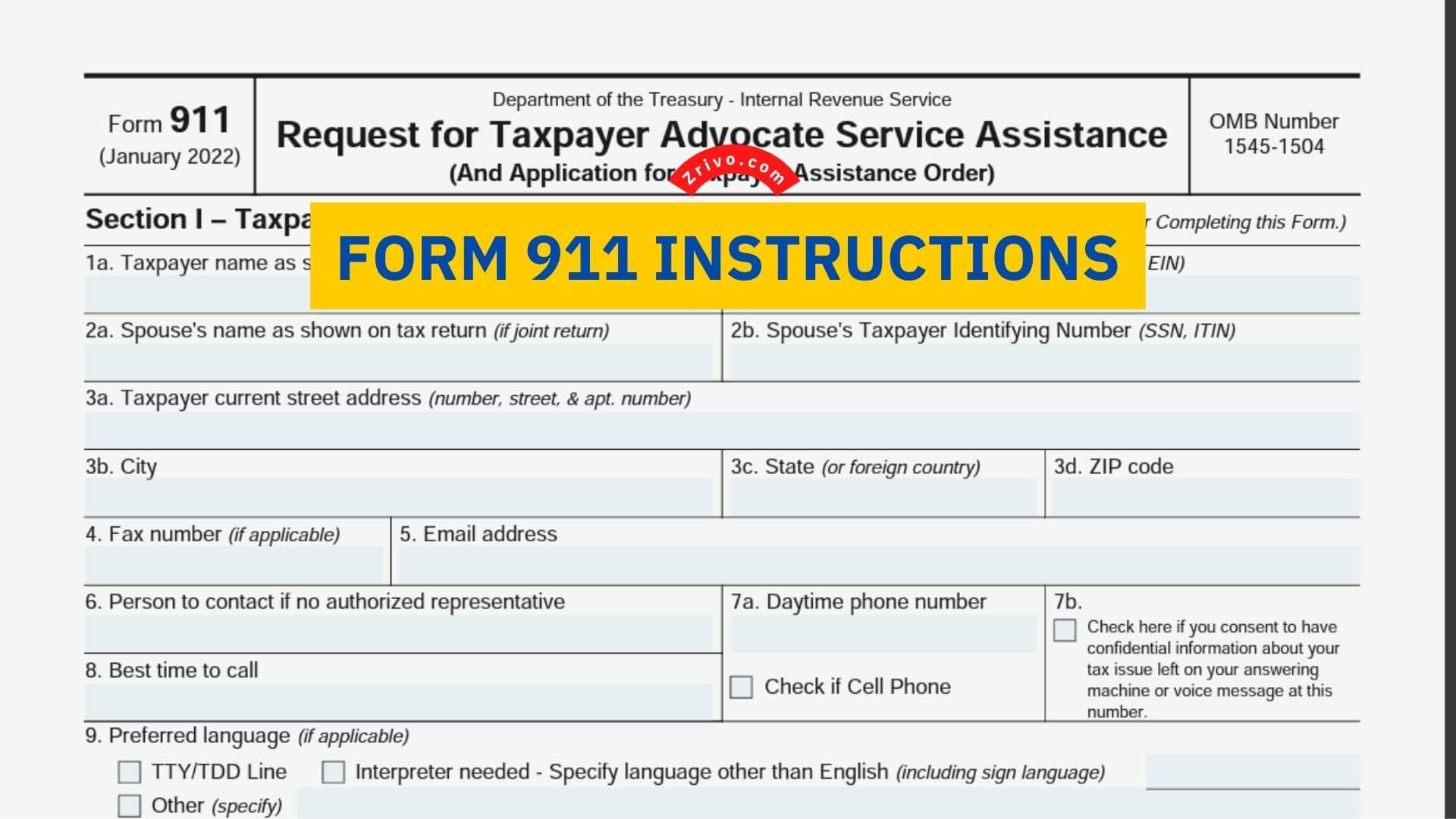

The Form 911, or Request for Taxpayer Advocate Service Assistance, is a two-page document that outlines what type of assistance you are seeking. The form requires a few pieces of information, such as your name and address, tax form number, phone number, and tax return date. You can submit the form via fax, Mail, or online.

The IRS has many forms to help taxpayers file their tax returns. These forms are designed to address the needs of individual taxpayers. Hiring a tax professional to fill out these forms is not necessary.

What is Form 911?

Form 911 is an IRS form used to request assistance from the Taxpayer Advocate Service. This service is an independent division of the IRS. Its objective is to protect the rights of taxpayers.

You can use Form 911 when you have a tax issue that is causing you economic harm. The Taxpayer Advocate will contact you within a few days to help you resolve your tax problem. However, Form 911 is the last resort; you should only submit it once you have exhausted all other options.

Using the IRS Form 911 is a good idea for taxpayers facing an adverse action or a tax problem that can’t be resolved using the normal Division channels. The IRS is willing to help at least half of the taxpayers who apply for Taxpayer Assistance Orders.

How To File Form 911?

Obtaining the IRS Form 911 can be important if you have a legitimate tax problem. The form is a tool for taxpayers to obtain assistance from the Taxpayer Advocate Service, which is an independent organization within the IRS.

The form includes a section designed to help you decide whether you need a lawyer. You can find this section on the form itself or by visiting the Taxpayer Advocate Service website. It contains information about what types of services you can obtain from a tax attorney and why you may be eligible.

The IRS has offices in all 50 states, Puerto Rico, and the District of Columbia. These offices can assist taxpayers who are experiencing economic hardship, are unable to resolve IRS issues through the normal channels or feel that the IRS is not following its rules.

Where to File Form 911?

You can submit Form 911 through:

- Mail: You can find the mailing address and phone number (voice) of your local Taxpayer Advocate office in your phone book, on IRS’s website, and in Pub. 1546, or get this information by calling IRS’s toll-free number: 1-877-777-4778.

- Fax: TAS has at least one office in every state, the District of Columbia, and Puerto Rico. Submit this request to the TAS office in your state or city.

- By visiting your local IRS office.

The IRS’s Taxpayer Advocate Service is an independent organization within the IRS that supports taxpayers who are having trouble resolving IRS issues through normal channels. You’ll need to face financial difficulty or a tax problem threatening your well-being.

The IRS should respond to your request within a couple of weeks. If you have not heard from the TAS after this time, you’ll need to contact the Taxpayer Advocate office where you submitted the request.

How to Fill Out Form 911?

- First, Form 911 requires a description of the issue. You’ll also want to include a description of the relief you are seeking. This could include abatement of a penalty, releasing an improper levy, or responding promptly to your request.

- The IRS will need basic information about you, including your name, address, social security number, phone number, email address, and tax year. If you’re requesting help from the Taxpayer Advocate Service (TAS) or have a valid power of attorney, you’ll want to include a representative’s name.

- A list of possible relief actions is also a good idea. Having this information will help your TAS representative understand what you’re looking for and may result in a quicker resolution.

Form 911 Fax Numbers

If you are sending the form from overseas, Fax your Form 911 to:

1-855-818-5697 or Mail it to Taxpayer Advocate Service, Internal Revenue Service, PO Box 11996, San Juan, Puerto Rico 00922.