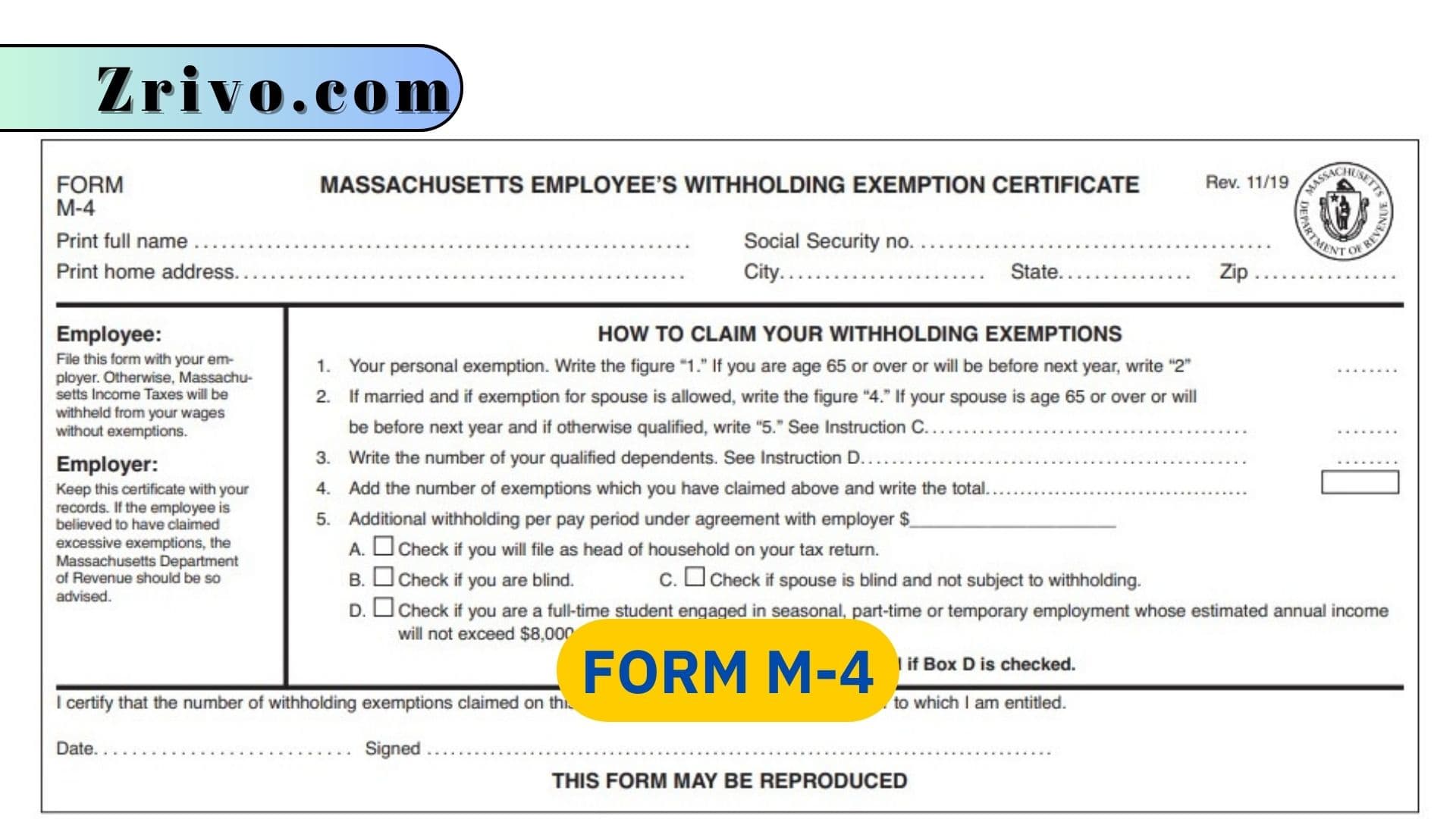

Form M-4

This article aims to provide a comprehensive understanding of Form M-4 by addressing its purpose, who needs to file it, how to file it, and how to properly fill out the form.

Form M-4, also known as the Massachusetts Employee’s Withholding Exemption Certificate, is a document used by employees in Massachusetts to inform their employers about their state tax withholding preferences. Form M-4 is a tax document specific to Massachusetts and is used to determine the amount of state income tax to withhold from an employee’s wages. It informs the employer about the employee’s withholding preferences and helps ensure accurate tax withholding throughout the year.

The primary purpose of Form M-4 is to allow employees to indicate their state income tax withholding preferences to their employers. By completing this form, employees can specify their filing status, the number of exemptions they are claiming, any additional withholding amounts, and any other necessary information required by the Massachusetts Department of Revenue (DOR).

Who Must File Form M-4?

All employees working in Massachusetts must file Form M-4 with their employers. This includes both residents and non-residents who earn income within the state. Employers use the information provided on Form M-4 to determine the correct amount of state income tax to withhold from an employee’s wages.

To file Form M-4, employees must obtain the form from the Massachusetts DOR’s website or their employer. The completed form should be submitted to the employer, who will then use the information provided to calculate the appropriate amount of state income tax withholding from the employee’s wages.

How to Fill out Form M-4?

When filling out Form M-4, employees must provide accurate information to ensure proper tax withholding. Here are the key sections of the form:

- Enter your name, Social Security number, address, and filing status (e.g., single, married, filing jointly).

- Enter the number of personal exemptions you are claiming. This number depends on factors such as your marital status, dependents, and eligibility for certain deductions.

- If you wish to have additional state income tax withheld from your wages, enter the additional amount in this section. This can help ensure you meet your tax obligations and avoid underpayment penalties.

- Sign the Form

Form M-4 plays a crucial role in ensuring accurate state income tax withholding for employees in Massachusetts. By completing this form correctly and providing necessary information, employees can help their employers determine the appropriate amount of state income tax to withhold from their wages. It is essential to review and update Form M-4 whenever personal circumstances change to ensure accurate withholding throughout the year. Employees should consult the Massachusetts DOR’s instructions or seek guidance from a tax professional for specific advice related to their individual tax situation.