Unclaimed property is a complex issue with numerous compliance obligations. It involves identifying and reporting items of property, tracking dormancy periods, undergoing due diligence, and filing reports. The process can be stressful and consume valuable internal resources. Fortunately, the Sovos UP Compliance Hub can help to manage these responsibilities. The state of New Jersey’s unclaimed property law requires that companies — known as holders — perform annual due diligence and report any unclaimed property to the Unclaimed Property Administration (UPA). Holders must also send a letter of notification to the apparent owner of abandoned property if it costs $50 or more.

Generally, properties are deemed to be abandoned after a specified period of time that varies by property type. For example, the dormancy period for utility deposits is one year, while it’s three years for payroll checks. Upon expiration, the property must be transferred to the state.

The UPA’s escheatment laws are designed to make property available to rightful owners. To do so, the State has a Voluntary Disclosure Agreement (VDA) program. This program allows holders to voluntarily report and remit past unclaimed property for a 10-year reach-back period. In exchange, the holder must agree to comply with state unclaimed property laws for future reporting periods. This is an important step to take for businesses that want to avoid costly penalties and fines.

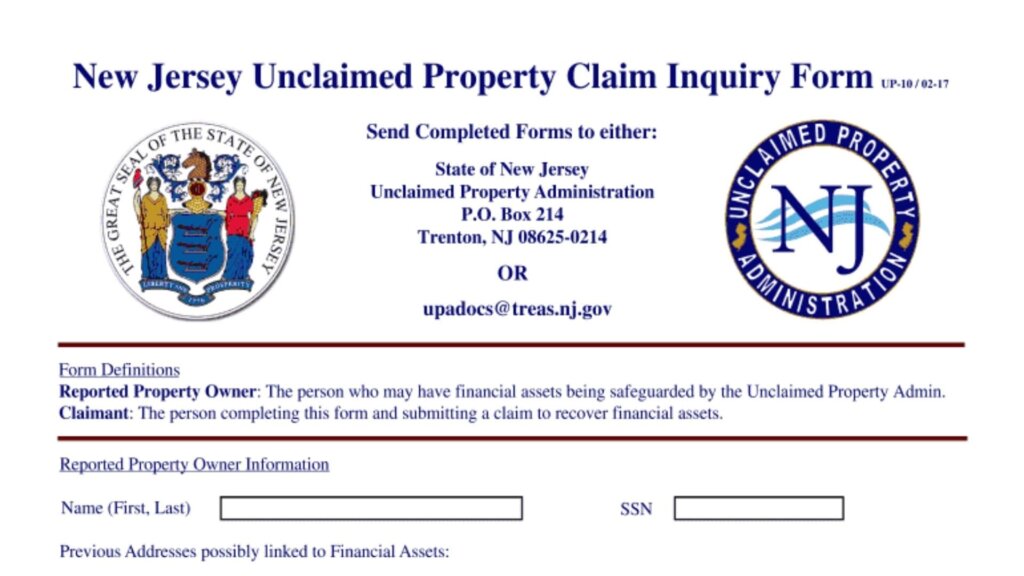

NJ Unclaimed Property Claim Form

The Unclaimed Property Claim Form New Jersey is a document that helps people locate their forgotten assets. These include bank deposits and safe deposit boxes, government checks, available credits, utility refunds, and more. It is important to know how this process works and what steps are involved before filing a claim. This blog post will give you all the information you need to start!

State law requires banks, insurance companies, utilities, and other businesses to turn over dormant savings accounts, life insurance policy dividends, stock or bond holdings, and uncashed checks to the state. These funds are considered abandoned after a certain amount of time, and the state will try to find the rightful owner.

You can check if you have any unclaimed property in the state of New Jersey by visiting their website. The search page allows you to enter your last name or business name, and you can refine your results by adding your first name, city, zip code, or property ID. The website also has an FAQ section, which answers commonly asked questions about the unclaimed property process. Once your search is complete, you will receive a Claim Reference Number, which will appear on any correspondence sent to you from the UPA.