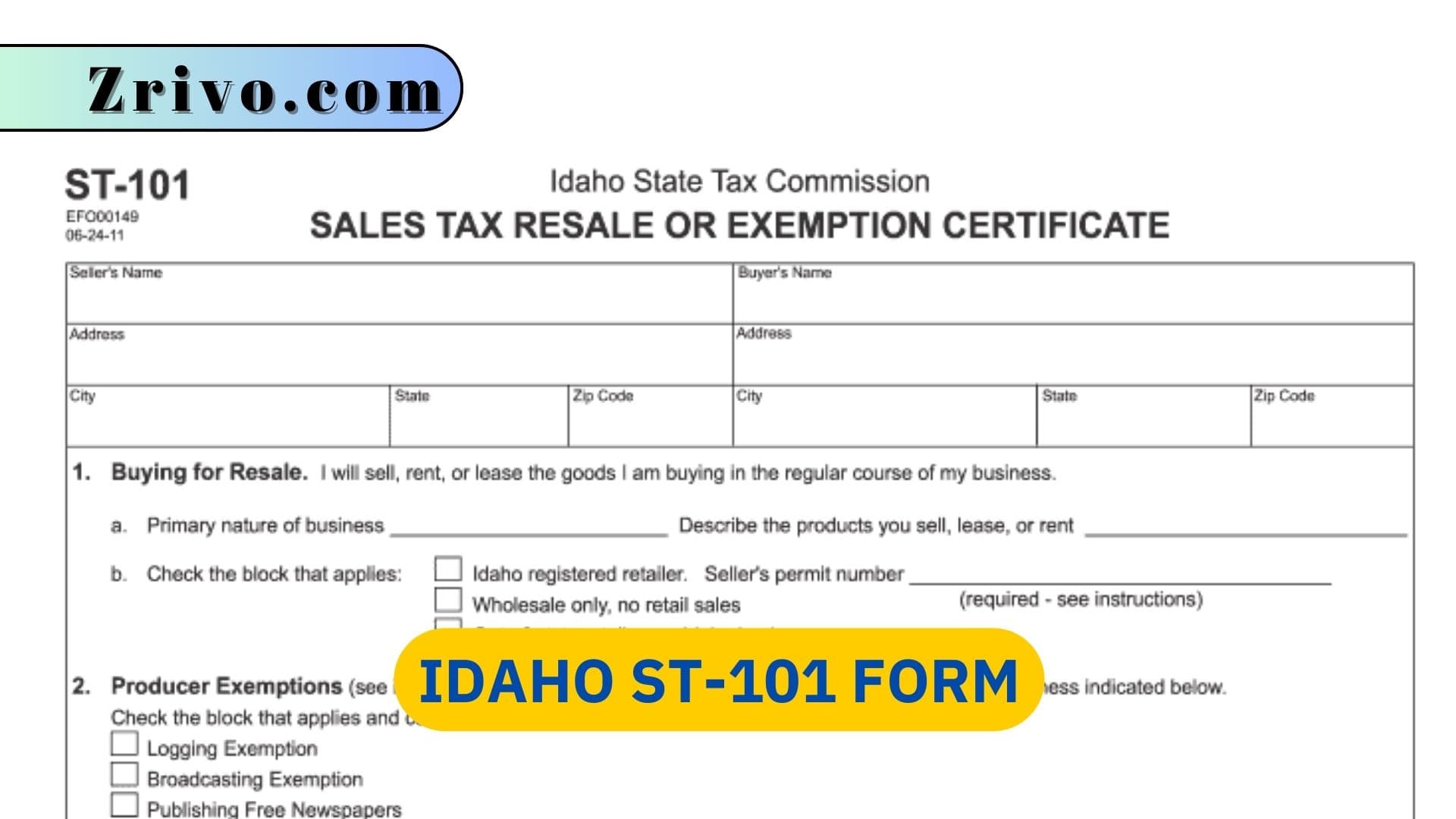

Idaho ST-101 Form 2023 - 2024

The Idaho ST101 form is a tax return used to report taxable sales and determine tax liability. The form requires a variety of information, including business information (legal name, address, and EIN), taxable sales, and deductions and credits.

Businesses that sell tangible personal property or provide taxable services in the state of Idaho must file Idaho Form ST-101. The form provides information about taxable sales and use taxes that are owed by the business. Generally, the form requires basic business information, including the legal name, address, EIN, and the reporting period (monthly, quarterly, or annually). It also requests a list of taxable sales and sales tax collected during the reporting period.

In some cases, the form may require additional sections or schedules that detail specific information. For example, if you operate a ski resort, the form will require you to list the parts, material, and equipment that are exempt from sales tax. Additionally, you’ll need to list the number of skiers that are exempt from sales tax.

Other specific exemptions include items used for research, development, experimental, or testing at the Idaho National Engineering and Environmental Laboratory, certain medical goods, and pollution control items. Nonprofit community centers for senior citizens and volunteer fire departments are also exempt from sales tax.

How to File the Idaho ST101 Form?

In Idaho, the filing of state tax forms takes place online. Individuals or businesses may file online through the state tax commission’s website or may complete a paper form and submit it to the Commission. The specific guidelines and requirements for filing vary depending on the type of return being filed. It is always recommended to consult with the Commission or a tax professional for accurate and up-to-date information.

When filling out the ST-101 Idaho form, it is important to accurately provide all requested information. The information reported will help the Commission determine a taxpayer’s tax liability. It is also important to correctly calculate the tax liability based on the income and deductions claimed on the form. Once the form is filled out, a signature must be provided to certify that all information on the return is true and correct.

In addition to the name and address of the purchaser, the ST-101 form requires the seller’s permit number and ID number, if applicable. Buyers who are exempt from sales tax should write their exemption number in the ID section of the form. The form is designed for buyers who intend to resell goods and services in Idaho. It does not apply to buyers obtaining materials for construction projects, buying equipment used in agricultural irrigation or production, and those who purchase liners and reagents for pollution control activities.