K-1 Tax Form

Schedule K-1, or K-1 tax form for short, is an IRS document showing a partnership or S corporation's income, deductions, and credits. Proceed if you need help with K-1 Tax Form.

The K-1 tax Form is a pass-through document that allows businesses to report income and losses to the IRS. This form can be used by partnerships, S corporations, and limited liability companies (LLCs). The IRS considers a business to be a pass-through entity when it doesn’t pay income tax directly on its profits. Instead, the income passes to its shareholders, partners, or beneficiaries. They record their share of the business income on their personal tax returns. A business must send out a K-1 to all its partners or shareholders each year by March 15. The information from this form is transferred to the partner or shareholder’s personal tax return so that they can calculate their taxable income and taxes on it.

If you’re a partner, it’s important to fill out this form correctly so that you can avoid paying too much or too little in taxes. In addition, you should be sure that your income and expenses are correctly reported so that you can make a claim on your tax return. You may also receive a Schedule K-1 if you invest in an exchange-traded fund (ETF) structured as a limited partnership. This form shows the partnership’s share of income, losses, and other information about your investment in the ETF.

K-1 Tax Calculator

If you are a business partner or S corporation owner and receive Schedule K-1 income, you must know how to correctly calculate your tax basis for reporting purposes. Without correct basis information, you could be penalized for failing to report your share of the business on your tax return.

When a K-1 is issued by a partnership, it will state the basis or ownership stake of each individual partner. It will also show how much each individual has received from the partnership, including rental income from real estate and earnings from bond interest and stock dividends.

Each partner’s basis will differ depending on their investment in the business. This includes cash contributions, equipment, and real estate property. A partner’s initial cost basis will be shown on the K-1, and the adjusted basis will be how this cost basis has changed due to contributions and distributions.

Another important consideration when calculating the K-1 basis is the amount of income an owner has accepted from the company throughout the year. If an owner accepts more income than allowed, it can cause reconciliation issues with the K-1.

The IRS allows pass-through businesses to deduct up to 20% of their net business income from their personal tax liability. This can be a valuable tool for owners who are not able to afford to pay their own taxes. However, consulting with a qualified tax advisor before taking this route is important.

K-1 Tax Document

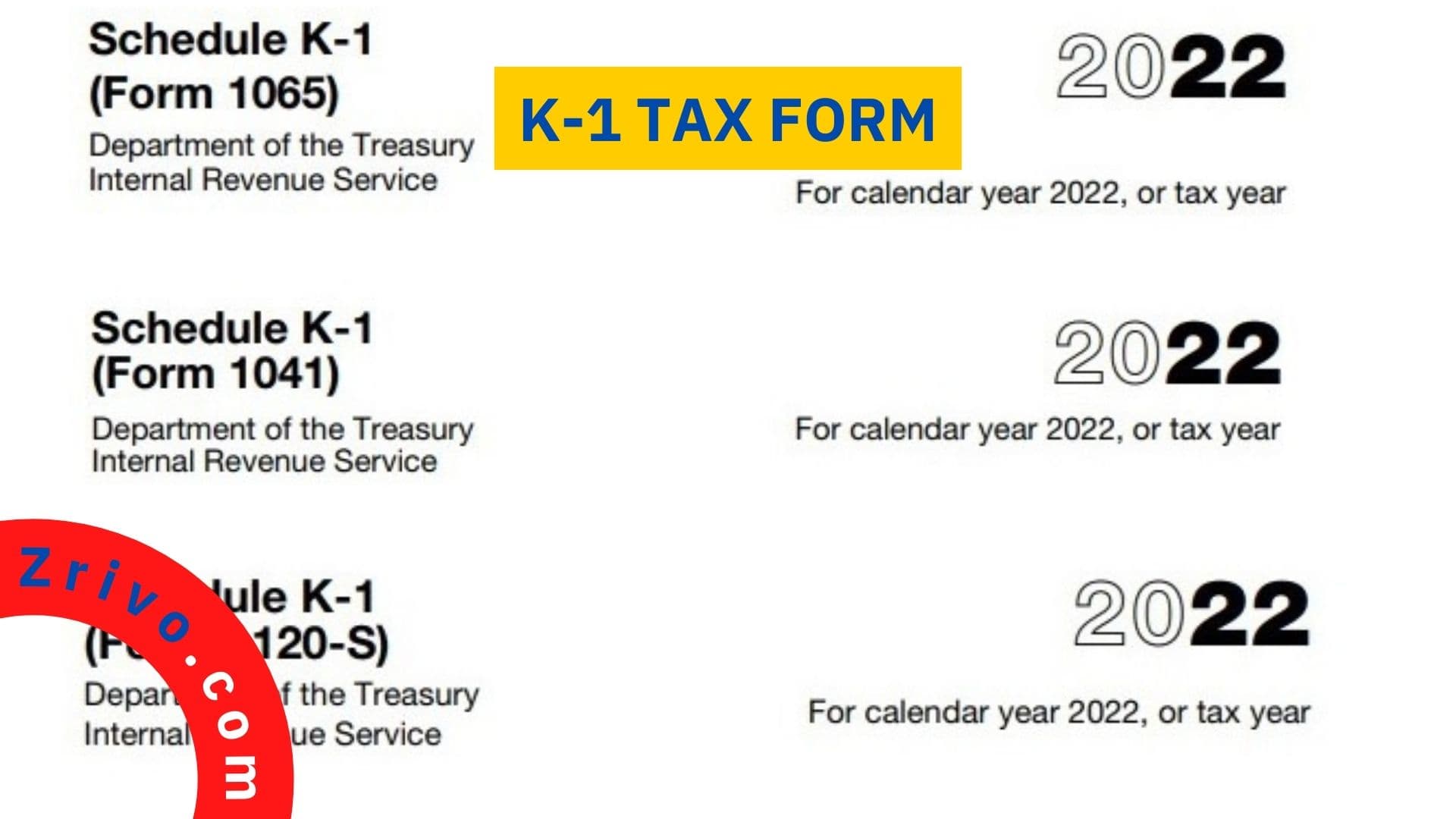

There are different forms of the k-1 tax document for partners, shareholders in an S-corporation, and beneficiaries of a trust or estate. The information reported on these forms differs, so using the correct form for your situation is important.

For example, if you are a partner in a partnership, the k-1 form should reference Form 1065. For S-corporations, Form 1120S should be used, and for trusts and estates, Form 1041 is the form that should be used.

The k-1 tax document is very detailed and can be confusing to many people, so it is important to have someone knowledgeable on hand when completing the form. It is also crucial to make sure that all the information is accurate, so it can be sent correctly to the IRS.

K-1 Tax Form Deadline

The k-1 tax form deadline is a critical date for pass-through entities. Partnerships, LLCs, and S-corporations must issue the k-1 to individual partners or shareholders by March 15, so they have enough time to incorporate it into their personal returns before the due date of April 15.

Most pass-through entities own closely held businesses and generate deductions and credits that are unique and complex. These deductions and credits must be calculated and reported on complicated supplemental forms and schedules before a business can issue the K-1 to owners.

Moreover, the k-1 deadline is much earlier than other due dates for various tax returns like 1099s because pass-through entities need to send the K-1 to partners or shareholders before they can file their tax returns. If a partner does not receive the k-1 on or before March 15, he or she must file for an extension.

It is important to get your tax information into your accountant as soon as possible so they can prepare your return. This will give them more time to complete the return and reduce delays for your company.

If you do not receive a k-1 by the due date, you can request an extension on Form 4868. You could use this extension if you did not receive the k-1 from a trust in which you are a beneficiary or if a natural disaster interrupted your business operations during the year.

K-1 Tax Form Trust Distribution

The k-1 tax form is an official IRS form that reports a beneficiary’s share of income, deductions, and credits. It also contains information about the estate or trust that generated this income.

A beneficiary receives the form from the fiduciary responsible for handling the disposition of the estate or trust. It consists of three parts: part one, which records the name and employer identification number of the fiduciary; part two, which lists the beneficiaries; and part three, which records the amount of money distributed from the estate or trust.

Generally, the Internal Revenue Service assumes that money placed into a trust was already taxed before it was put into the trust. This is why a beneficiary does not have to pay taxes on distributions from the principal balance of the trust.

However, the interest income the trust accumulates must be taxable to the beneficiary or the trust itself. This is because the IRS assumes that this money was already taxed before it was placed into the trust, so the amount of interest accumulated by the trust is considered income and is subject to taxes.

In addition to distributing this income, the trust may set a portion of its distributions for charitable purposes. If the trust operates exclusively for charitable purposes, this portion of its distributions is exempt from federal income taxes.