Texas Car Sales Tax

Car sales tax is one of the most important taxes for dealerships to calculate and collect. Texas has a statewide sales tax of 6.25%, and buyers are also responsible for county and city taxes.

The state of Texas has a car sales tax that is applied to every vehicle purchase. This tax varies by county and city, but generally, it is about 6.25% of the final price. This tax is in addition to any local or county taxes that are collected on the vehicle. In many cases, dealers will offer manufacturer rebates and cash rewards on top of the asking price of a new vehicle. The sales tax calculation often includes these and must be subtracted from the asking price to arrive at the true sales value.

For private-party purchases or vehicles brought into the state of Texas from another country, sales tax is based on a comparison between the purchased price and the vehicle’s standard presumptive value (SPV). This calculation is made by a certified dealer or private-party purchaser with a valid Texas appraisal report.

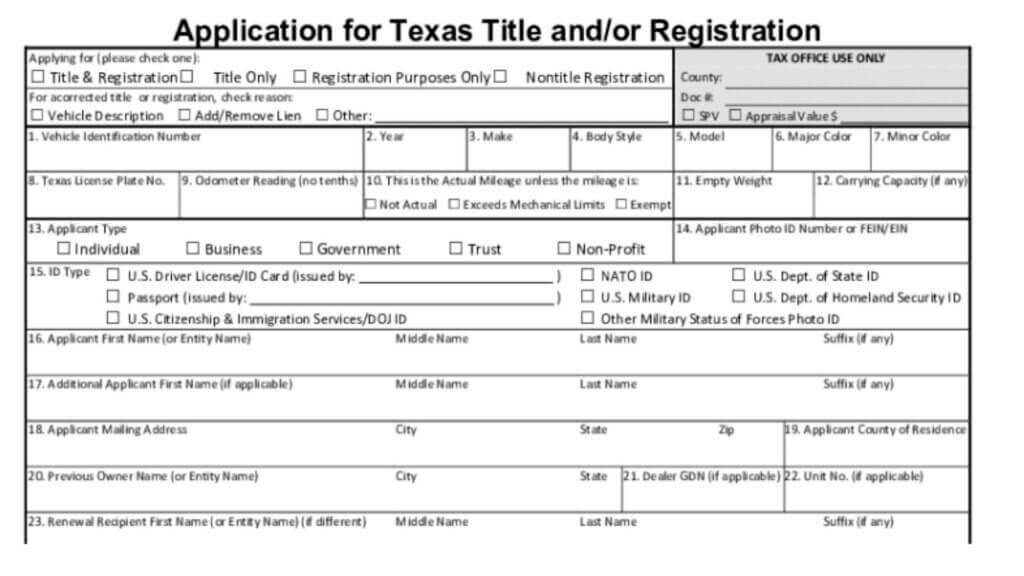

The dealer must remit the motor vehicle sales tax to the county tax assessor-collector within 30 days of delivery. Proof of delivery is usually a manufacturer’s certificate of origin on a new vehicle, the date of transfer on a used vehicle or Form 130-U, Application for Texas Title and/or Registration, signed by the dealer and the purchaser.

How to File Texas Car Sales Tax?

To file Texas Car Sales Tax, you’ll generally need to send the following to your local county’s tax assessor-collector’s office:

- A completed Application for Texas Title and/or Registration form (Form 130-U) – This form might be provided by the dealer, or you can get it from your local office.

- Proof of sales tax payment:

- If you purchased from a licensed dealer, the sales tax should have already been included in the final sales price. You won’t need to pay anything extra, but keep your bill of sale as proof the tax was collected.

- If you bought from a private seller and paid the sales tax at the time of purchase, you’ll need a bill of sale showing the tax amount collected.

- If you didn’t pay sales tax when buying from a private seller, you’ll need to calculate the tax yourself (explained below) and submit payment with Form 130-U.