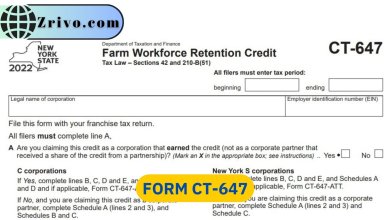

The Farm Workforce Retention Credit 2023 - 2024

Whether you are a small business or a large corporation, the farm workforce retention credit is a great way to keep your employees. This refundable credit is available to eligible New York State businesses.

Contents

Is your farm losing employees because they are getting paid more than the Fair Labor Standards Act minimum wage? You may be eligible to receive a tax refund. This credit is called the farm workforce retention credit, and it can help you offset your costs. The farm workforce retention credit is a refundable tax credit for farmers and owners of farm employers that allows them to receive $600 to $1,200 per eligible farm employee. This credit is available from January 1 through July 31 of each year.

It is one of many refundable tax credits that New York State offers to help farm businesses offset the cost of overtime wages. While it is not a cash cow, it can be a boon to small businesses and helps to ensure that the agricultural sector continues to thrive in the state.

How to Qualify for Farm Workforce Retention Credit?

To qualify for this credit, farmers must have a taxable federal gross income from farming in the tax year and have at least five hundred hours of work by their farm employees during that year. This includes workers who are part of the H-2A Temporary Agricultural Worker Program. This refundable tax credit is available through the New York Department of Taxation and Finance (NYDTF). It is a good way to help farm businesses keep their workers and increase their productivity. Since it was enacted in 2016, this credit has been a great resource for New York State farms and ag businesses. It is a refundable credit that helps to offset the cost of overtime wages and encourages businesses to keep their employees. To apply for the credit, farmers need to fill out and submit a Form CT-647

In 2021, the credit was increased to $600 per farm worker, increasing to $1,200 for 2023 and 2025. This will allow more farmers to take advantage of the credit. If you have questions about the credit or want more information, schedule an appointment with a tax specialist. They will be happy to answer any of your questions and guide you through the process of claiming the credit.

Advantages of the Farm Workforce Retention Credit

The Farm Workforce Retention Credit (FWRC) is a tax credit designed to incentivize employers in the agricultural industry to retain their employees by providing a financial benefit for doing so. Here are some of the advantages of the FWRC:

- The FWRC provides eligible employers with a tax credit that can be used to offset their tax liability, which can result in significant financial savings.

- The credit is designed to encourage employers to retain their current employees by providing a financial incentive. This can help employers retain experienced and trained employees, which can be beneficial for the business.

- By retaining experienced employees, employers may be able to improve the efficiency and effectiveness of their operations. This can lead to cost savings and increased productivity.

- By retaining employees and improving their operations, businesses may gain a competitive advantage over their competitors in the agricultural industry.

- The FWRC is a targeted tax credit that supports the agricultural industry, an important sector of the economy. By incentivizing employers to retain their employees, the credit can help support the continued growth and success of the industry.

Disadvantages of the Farm Workforce Retention Credit

While the Farm Workforce Retention Credit (FWRC) can provide significant advantages for eligible employers in the agricultural industry, there are also potential disadvantages to consider, including:

- The FWRC is only available to employers in the agricultural industry who employ qualified employees. This means that not all employers may be eligible for the credit.

- The FWRC is currently only available for tax years 2021 and 2022, which means that it may not provide a long-term solution for employers who are looking to retain their employees.

- In order to claim the FWRC, employers may need to keep detailed records of their employees’ hours worked and wages paid, which can be time-consuming and add to the administrative burden of running a business.

- The FWRC is a relatively new tax credit, and its rules and requirements may be complex and difficult to understand. Employers may need to consult with tax professionals or spend time researching the credit to ensure they are eligible and claiming it correctly.

- There is a risk that some employers may abuse the FWRC by claiming the credit for employees who are not qualified or by manipulating their employees’ hours worked or wages paid to maximize the credit. This could lead to audits or penalties for the employer.