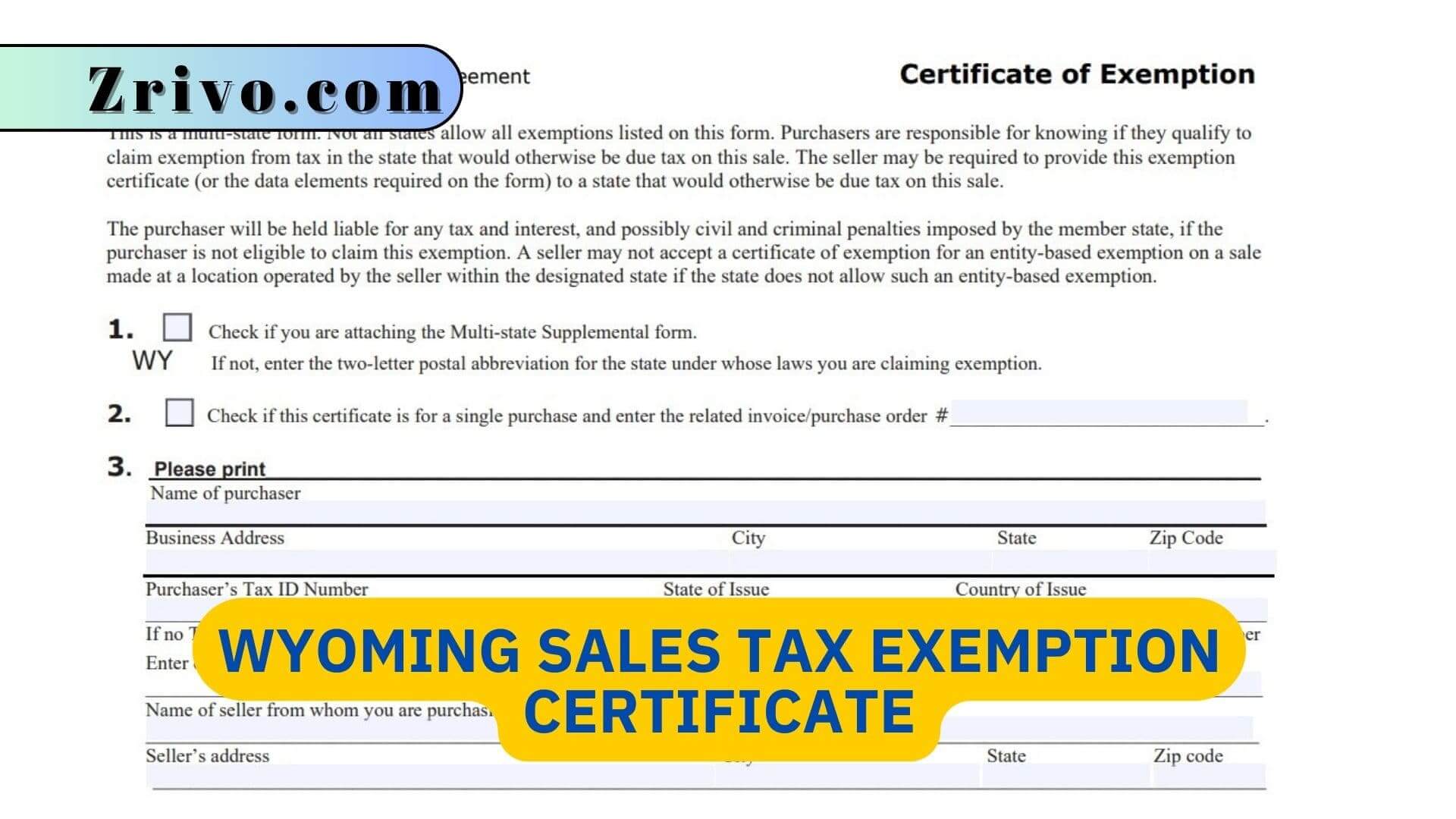

Wyoming Sales Tax Exemption Certificate

If a buyer is exempt from Wyoming Sales Tax, make sure they have a valid exemption certificate or resale certificate on file before making the sale. This will help you avoid penalties in case of an audit.

If you have sales tax nexus in Wyoming and sell taxable goods or services to residents, you’re required to register, collect, and remit the proper amount of state sales tax. You also need to file returns and keep detailed records. Failure to do so can result in penalties and interest charges. Some sales are exempt from sales tax, such as purchases of food and certain medical supplies. Also, sales to nonprofit organizations, schools, and governments are generally exempt. Understanding these exemptions is important to avoid over or under-collecting sales tax.

A Wyoming sales tax or resale certificate is required for businesses that sell taxable products or services. A resale certificate acts as an intermediary between you and the state, collecting tax dollars from your customers and passing them on to the tax authorities. To stay in compliance, you must keep track of the sales taxes you collect and remit.

How to Get a Sales Tax Certificate in Wyoming?

The first step to getting a Wyoming sales tax certificate is to gather all your business details. You’ll need your company name, address, contact info, and either your Social Security Number or Federal Employer Identification Number (EIN). Once you have all of the information, head to the WYIFS website.

You’ll need to create an account, and then the system will guide you through the process of registering for your sales tax certificate. Once registered, you’ll need to file returns based on your expected sales volume. The Department of Revenue will assign you a filing frequency, which is typically monthly or quarterly. Online filing is preferred, but you can also submit a paper return.

While it’s unlikely that an exemption certificate will expire, you should always keep a copy in case of an audit. Changes to a company’s name, ownership, or address can also invalidate a resale or blanket exemption certificate. To ensure that your certificates are valid, verify their details with each vendor before making a purchase.

How Do I Become Tax-exempt in Wyoming?

The first step to becoming tax exempt in Wyoming is registering with the state. You can do this via the WYIFS website, your personal trailhead into the sales tax frontier. Follow the prompts and submit your application to complete the registration process.

Next, you need to gather all your sales records for the filing period. You can use a mobile point of sale system or a business accounting software to make this easier. Once you have all your sales data, head over to the WYIFS site and log in using your credentials. Select the correct filing period and click “submit.”

Once registered, you must apply the appropriate sales tax rate to your taxable sales. You must also remit the collected tax to the state. In addition, you must keep excellent records. Some goods and services are exempt from sales tax in Wyoming, including groceries, prescription drugs, medical equipment, raw materials for manufacturing, and sales to government agencies, schools, and nonprofit organizations. However, if you aren’t sure whether you qualify for an exemption or resale certificate, you should consult with an attorney to ensure your eligibility.