Form 1040-V is the payment voucher for federal income taxes paid to the Internal Revenue Service. File and mail Form 1040-V along with your federal income tax return (Form 1040, Form 1040-NR) to the IRS for the tax owed on the “Amount You Owe” line.

Form 1040-V PDF

Do not file Form 1040-V if you’re paying taxes electronically or making a payment at the IRS office in person. Only file Form 1040-V and mail it to Internal Revenue Service with your return if you’re paying taxes by money order or check order.

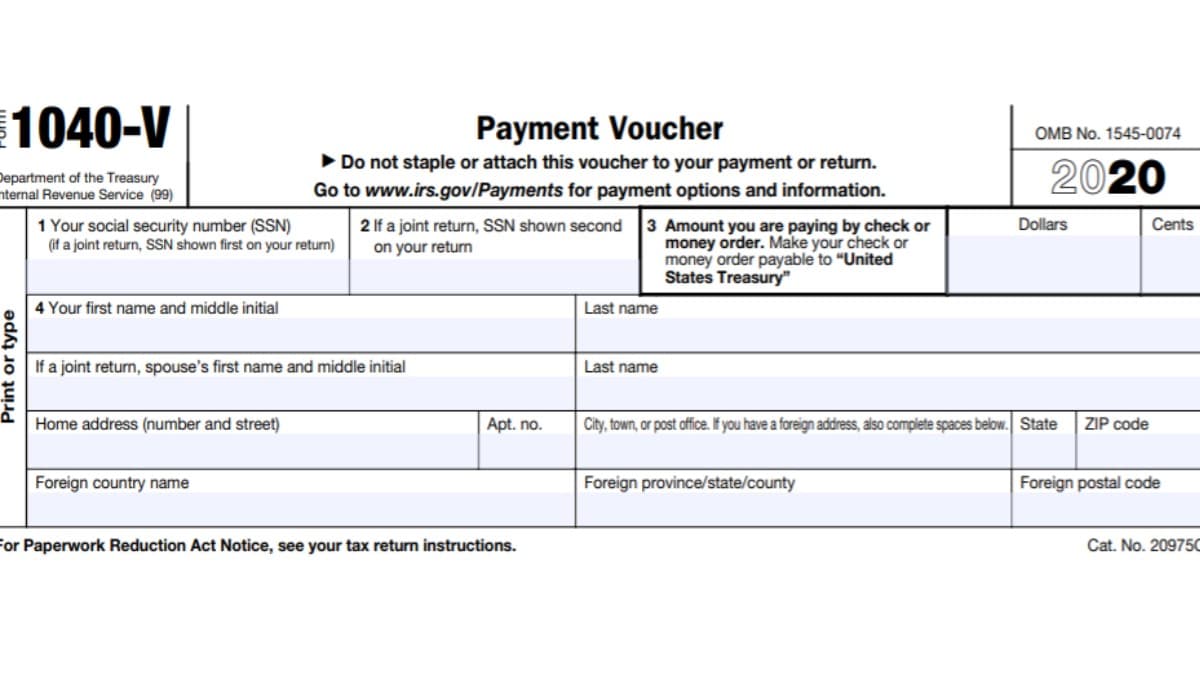

Since Form 1040-V is very straightforward, there isn’t a need for instructions, but here is what you’ll expect to enter on the form.

If you’re filing a joint return, enter your spouse’s information for what’s asked below.

- Social Security Number

- Full Name

- Home address

- Foreign address if you’re not a resident

After entering these, enter the dollar and cent amount of the tax paid to the IRS by money order or check order. Taxpayers who sent their federal income tax returns to the IRS and separately mailing the payment voucher, mail it to the address below.

Form 1040-V Mailing Addresses

| State | Mail Address |

|---|---|

| Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, New Mexico, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyoming | Internal Revenue Service P.O. Box 802501 Cincinnati, OH 45280-2501 |

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Pennsylvania, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Foreign Country | Internal Revenue Service P.O. Box 1303 Charlotte, NC 28201-1303 |

Step-by-Step Guide

- Download the Form: Taxpayers can obtain Form 1040-V from the official IRS website or from tax preparation software.

- Provide Personal Information: Enter your name, address, and Social Security number on the form to accurately identify yourself.

- Enter Payment Details: Specify the tax year, payment amount, and other relevant payment information.

- Detach and Mail: Tear off the payment voucher along the perforated line and mail it with your payment to the designated IRS address.

2024 Changes and Updates

In 2024, there were several changes to Form 1040-V, including updated tax rates, income thresholds, and deduction limits. Taxpayers should ensure they are using the correct version of the form that corresponds to the specific tax year.