1099-B Wash Sale Loss Disallowed

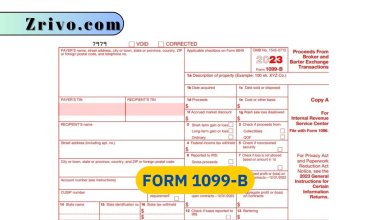

Form 1099-B, Proceeds from Broker and Barter Exchange Transactions is the information return that reports plenty of information. In particular with what’s reported on Form 1099-B, you should know about the wash sale rule. This rule was introduced to prevent people from selling securities at a loss to get a tax write off. If you’re affected by this rule, your loss will be disallowed, thus, you cannot claim a tax benefit for the loss that occurred.

The reason behind this rule is to make sure that everyone is paying taxes fairly. Without the wash sale rule, a taxpayer can purchase securities that knowingly will lose money, sell the security, and claim a tax benefit larger than the loss.

Wash sale loss disallowed example

Assume you bought 500 shares of a stock valued at $5,000 on August 1st. About 45 days later, the total value of the stock you purchased dropped to $4,000. You sold them to claim a tax write off as it’s a loss. On October 1st, the same year, you bought the same stock to cover up the loss. What this creates is you won’t get a tax write-off for the initial loss as it’s not allowed to be counted towards it because the stock was repurchased within the limited time period.

The limited time interval is 30 days. As long as there is 30 days between the sale and the purchase of the security, you won’t be subject to wash sale rule. The financial institution you’re working with will report these, so you don’t have to worry about them yourself. If an amount is reported on 1099-B Box 1g, this amount is not deductible off of your gross income.