Form 1099-NEC Instructions 2023 - 2024

Form 1099-NEC is a simple yet important information return that reports income paid to freelancers and contractors during the tax year that is at least $600. The Internal Revenue Service requires businesses to file Form 1099-NEC for every nonemployee that they've paid at least $600. In this guide to file Form 1099-NEC, we will go over everything you need to know about how, when, and where to file Form 1099-NEC.

Contents

The Form 1099-NEC has been re-introduced by the IRS to specifically address the reporting of nonemployee compensation. It is paramount for businesses and payers to understand the requirements and guidelines associated with this form, especially with regards to payments made to independent contractors.

Introduction to Form 1099-NEC

The IRS Form 1099-NEC is a crucial document that businesses and other entities use to report payments made for nonemployee compensation. Prior to 2024, nonemployee compensation was reported on Form 1099-MISC, but due to the increasing number of independent contractors in the workforce, a dedicated form was deemed necessary.

Who Must File Form 1099-NEC?

Any business entity or individual that makes payments totaling $600 or more to a non-corporate service provider or independent contractor within a year needs to file the Form 1099-NEC. This includes payments for services performed for a trade or business by individuals who aren’t treated as employees.

What Types of Payments Are Reportable on Form 1099-NEC?

The main purpose of Form 1099-NEC is to report Nonemployee Compensation. Typically, this includes:

- Fees

- Commissions

- Prizes

- Awards

- Other forms of compensation for services performed by someone who is not an employee.

Payments for materials, rent, or other business expenses are not reported on this form.

| Type of Payment | Reported on Form 1099-NEC? |

|---|---|

| Nonemployee Compensation | Yes |

| Rent | No |

| Employee Wages | No |

How to Fill Out Form 1099-NEC

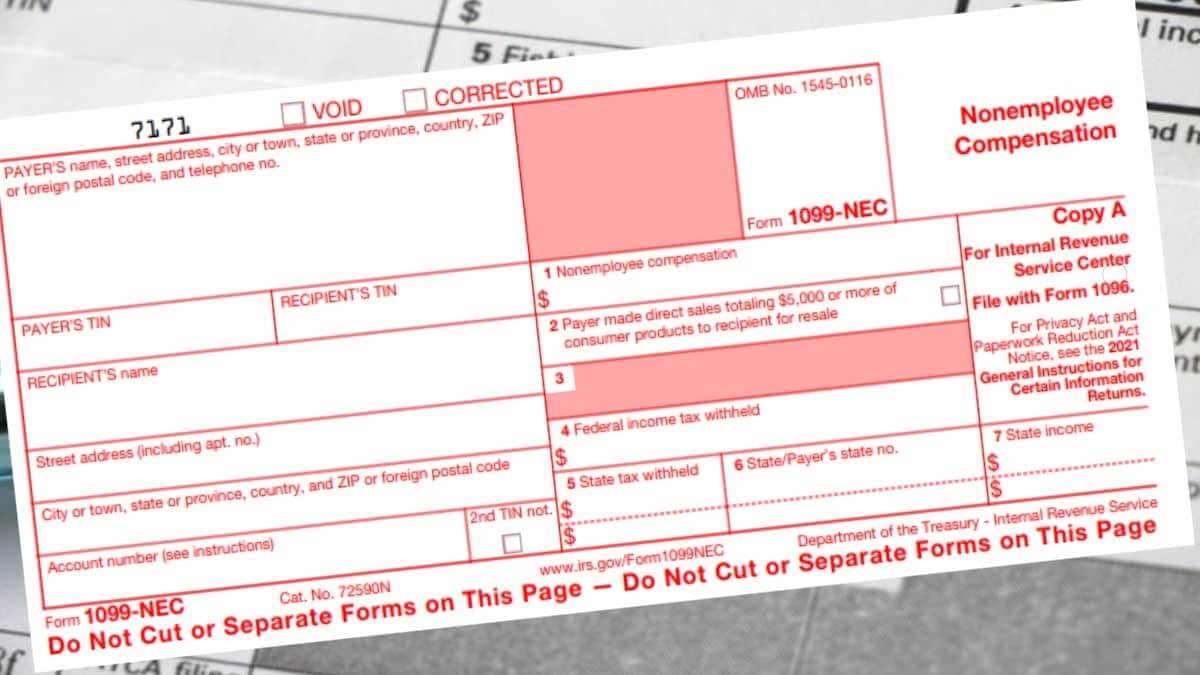

When completing the Form 1099-NEC, specific boxes need to be addressed:

- Box 1: Nonemployee compensation (Total payments made to the contractor)

- Box 2: Direct sales of consumer products for resale

- Box 3: Reserved for future use

- Box 4: Federal income tax withheld

- Box 5: State tax withheld

- Box 6: State/Payer’s state number

The form requires the payer to provide their details and the recipient (usually the independent contractor). Accurate financial details should be inputted to avoid any discrepancies.

When to File Form 1099-NEC

The due date for filing the Form 1099-NEC with the IRS and providing a copy to the recipient is January 31st of the year following the payment year. For instance, for payments made in 2023, the due date for Form 1099-NEC would be January 31st, 2024.

Where to File Form 1099-NEC

You can file Form 1099-NEC either electronically or by paper. If you choose the paper method, the forms should be sent to the address provided on the form instructions. Electronic filing is recommended for those filing 250 or more forms, as it is more efficient and reduces the chance of errors.

Form 1099-NEC Penalties

| Infraction | Penalty |

|---|---|

| Late filing or non-filing | $50 per form if filed within 30 days; $110 per form if filed more than 30 days late but before August 1; $280 per form if filed after August 1 or not filed at all. |

| Intentional disregard | $560 per form with no maximum. |

Penalties can be severe, so ensure that you adhere to the due date and accurately report all required information.

In conclusion, the Form 1099-NEC is an essential tool for businesses and other entities to report nonemployee compensation. Proper understanding of the instructions and timely filing can save a lot of hassle and potential penalties. It’s crucial to remain updated with IRS guidelines and ensure compliance.