1099 Filing Requirements

If you're a business owner or self-employed individual in the United States, understanding the 1099 filing requirements is crucial. In this comprehensive guide, we'll cover everything you need to know about 1099 forms, their filing requirements, and answer some common questions.

Contents

Forms 1099 are information returns that report income paid to individuals and businesses in a wide variety of ways. The Internal Revenue Service requires taxpayers to file the accurate Form 1099 depending on the type of payment made and the amount. If the payment exceeds a certain amount (for example, it’s $600 for Form 1099-MISC), the taxpayer has to file a copy of the 1099 Form and furnish the recipient and report it to the Internal Revenue Service.

The filing requirements for Forms 1099 vary based on which variation of the form we’re talking about. For example, the filing requirements for Forms 1099-INT and 1099-DIV that report interest income, and dividends and other distributions is $10. If the recipient got $10 or more in these types of payments, the payer must file 1099. It’s a simple as that.

Since the requirements change depending on the form and type of the payment, we highly suggest checking the requirements for the forms individually. We’ve already covered all the 1099s on our website. Check 1099s to see the individual requirements for every form.

When to file 1099?

Because Forms 1099 are information returns that report income paid to an individual or business alike, the filer must file and submit a copy to the recipient by the start of the tax season. Then, there is the 1096 which report the 1099s filed to the Internal Revenue Service. The deadline to Forms 1099 with the recipient is January 15 in most cases, but some forms that are used for business to business transactions can be filed by February 15.

The deadline to file Forms 1099 with the IRS is February 28 for mailed in tax forms and March 31 for electronically submitted ones. The penalty for late-filing 1099 generally starts at $50 per violation and can be as much as $540 if neglected.

What Happens if You Don’t File 1099 Forms?

Failure to meet the 1099 filing requirements can result in penalties. The IRS can assess penalties for not filing or for incorrect information on the forms. Penalties vary depending on the seriousness of the violation and the timing of correction.

What is a 1099 Form?

A 1099 form is an IRS document used to report various types of income, other than regular wages, salaries, or tips. It serves as a record of payments made to individuals or entities during a tax year. There are several types of 1099 forms, each designated for different income sources, such as 1099-INT for interest income and 1099-MISC for miscellaneous income.

Types of 1099 Forms

There are several types of 1099 forms, each used to report different types of income. Some common 1099 forms include:

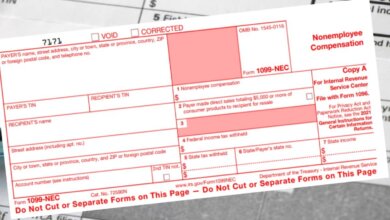

- 1099-NEC: Used to report non-employee compensation, such as payments to freelancers and independent contractors.

- 1099-MISC: Used for miscellaneous income, including rents, royalties, and other types of income.

- 1099-DIV: Reports dividends and distributions from investments.

- 1099-INT: Used to report interest income.

- 1099-B: Reports proceeds from broker and barter exchange transactions.