2210 Form 2023 - 2024

Form 2210 is the IRS tax form used by individuals, estates, and trusts to figure out the penalty of underpaying estimates taxes. Before you file Form 2210, you must figure out whether or not you’ve underpaid your taxes.

As for how you can know if you underpaid estimated taxes, you need to look at the statements for the months you made payments. You also have the option to get tax transcripts of your past tax returns to see if the estimated taxes were underpaid.

If so, fill out Form 2210 to figure out your penalty. However, underpaying estimated taxes isn’t going to grant you a penalty at all times. If the underpaid taxes is less than $1,000 after the tax withheld and credits are subtracted, there isn’t a penalty.

With that said, for you to be subject to estimated taxes underpayment penalty, the taxes underpaid must be more than $1,000 or less than 90% of the owed tax, whichever is smaller. Those who owe taxes can figure out their penalty by filling out Form 2021. It is available down below in printable and online fillable options.

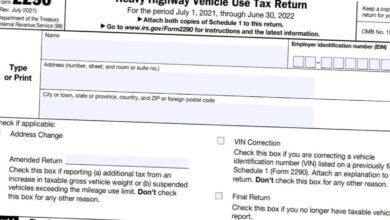

Filling Out Form 2210

You can fill out Form 2210 online.. If you’re filing a paper tax return, fill out Form 2210 below, then print out and attach it to your Forms 1040, 1040-NR, 1040-NR-EZ, or 1041. On the other hand, if you’re filing an electronic tax return, the tax software of your choice should offer this tax form.

Below Form 2210 for the 2024 tax season can only be used to fill out and print out for later use. Electronic filing is also available on IRS Free File.

You’re going to fill out Form 2210 with your tax return. Most of the information asked on it is already stated on your tax return. You shouldn’t have a problem with filling out Form 2210 for the 2024 tax season. Just in case though, we attached the instructions under the form.