Employers file multiple tax returns to report certain things to the Internal Revenue Service. Forms 944 and 941 are the most common two tax returns for employers. In context, both forms are the same but when it’s filed is different. Employers use Form 944 to report wages and other income paid to employees, and taxes withheld from their income.

While filing Form 941 might take some time to file, Form 944 is quite straightforward as you need to gather all the information for the tax year and enter the amounts on the form. Because you will file Forms 941 for every quarter of the year, enter the total amounts on Form 944 for quarters first through last, and mail it to the Internal Revenue Service. You can also file Form 944 electronically with a tax preparation service, not through Free File Fillable Forms.

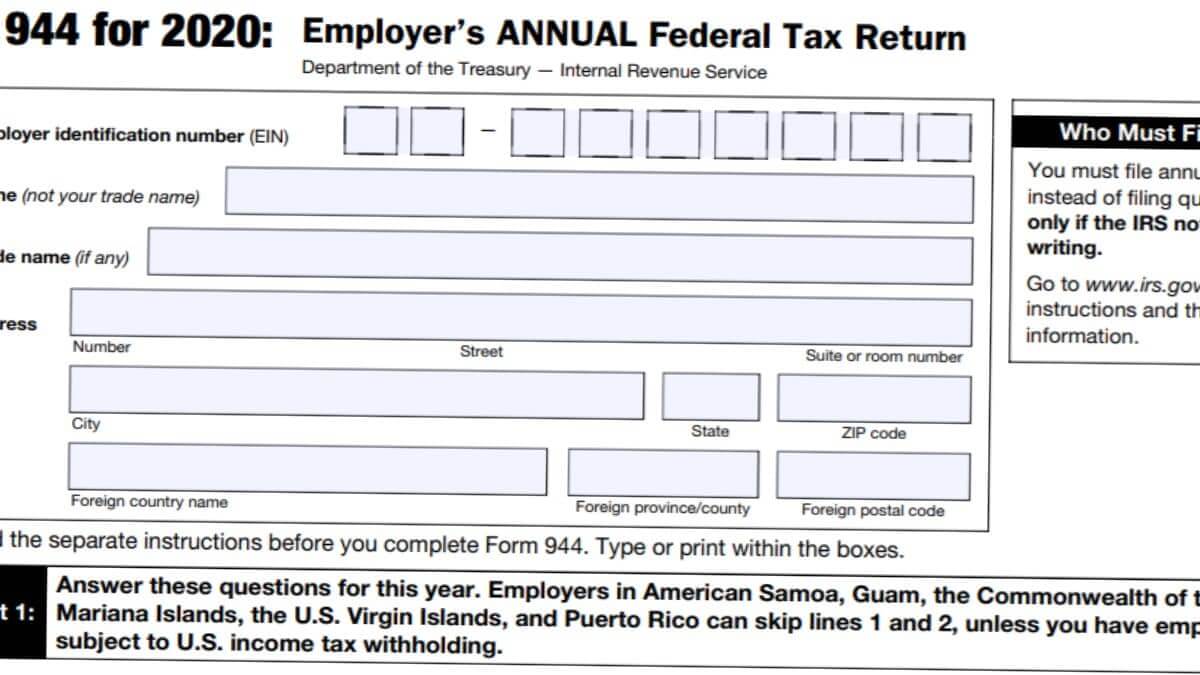

Form 944 Online Fillable PDF

File Form 944, Employer’s Annual Federal Tax Return online and print out a paper copy right away. The form is fillable online where you can enter money amounts and check the boxes by clicking on them. After printing Form 944, mail it to the Internal Revenue Service. The mailing address for the 944 is attached below.

Frequently Asked Questions about Form 944

Who files Form 944?

Every business owner who has someone working for them is required to file Form 944. Whether you have only one or multiple employees, you are required to file Form 944.

When is Form 944 due date?

Form 944 is a return, but the deadline to file is the same as information returns. You must file Form 944 and submit a copy to the IRS by January 31, following the end of the tax year. If not filed, the IRS will press interest and late filing penalties.

How to fill out Form 944?

File Form 944 on paper and mail it to the IRS or file it through a tax preparation service to submit electronically. If this is your first time filing Form 944, we highly suggest going through the instructions to file Form 944 for each box, so you don’t have to correct them later.