The Work Opportunity Tax Credit (WOTC) is a federal income tax credit available to private and for-profit employers. It reduces a business’s federal tax liability by crediting the employer with qualified wages paid to eligible employees over their first year. A tax-exempt, non-profit 501(c) organization that has received certification from participating in the program will use IRS Forms 5884 and 3800 to claim the credit. The credit equals 40 percent of qualified wages, up to $6,000 per employee.

In addition to the WOTC, several other credits are available for various purposes, including hiring employees from disadvantaged groups, paying taxes on tips, and reducing payroll costs. Some credits are available for some years, while others may only be valid for one year. For example, the IRS offers credit for employers that have experienced a qualified disaster. Employers affected by a disaster must fill out Form 5884-A when impacted and want to claim the credit.

There are a few things to remember when filing Form 5884-A, and it is a good idea to consult with your CPA or another tax adviser before completing the form. Also, be sure to coordinate the credit with other credits. If you use the same wages for more than one tax credit, it is important to ensure that each credit amount matches.

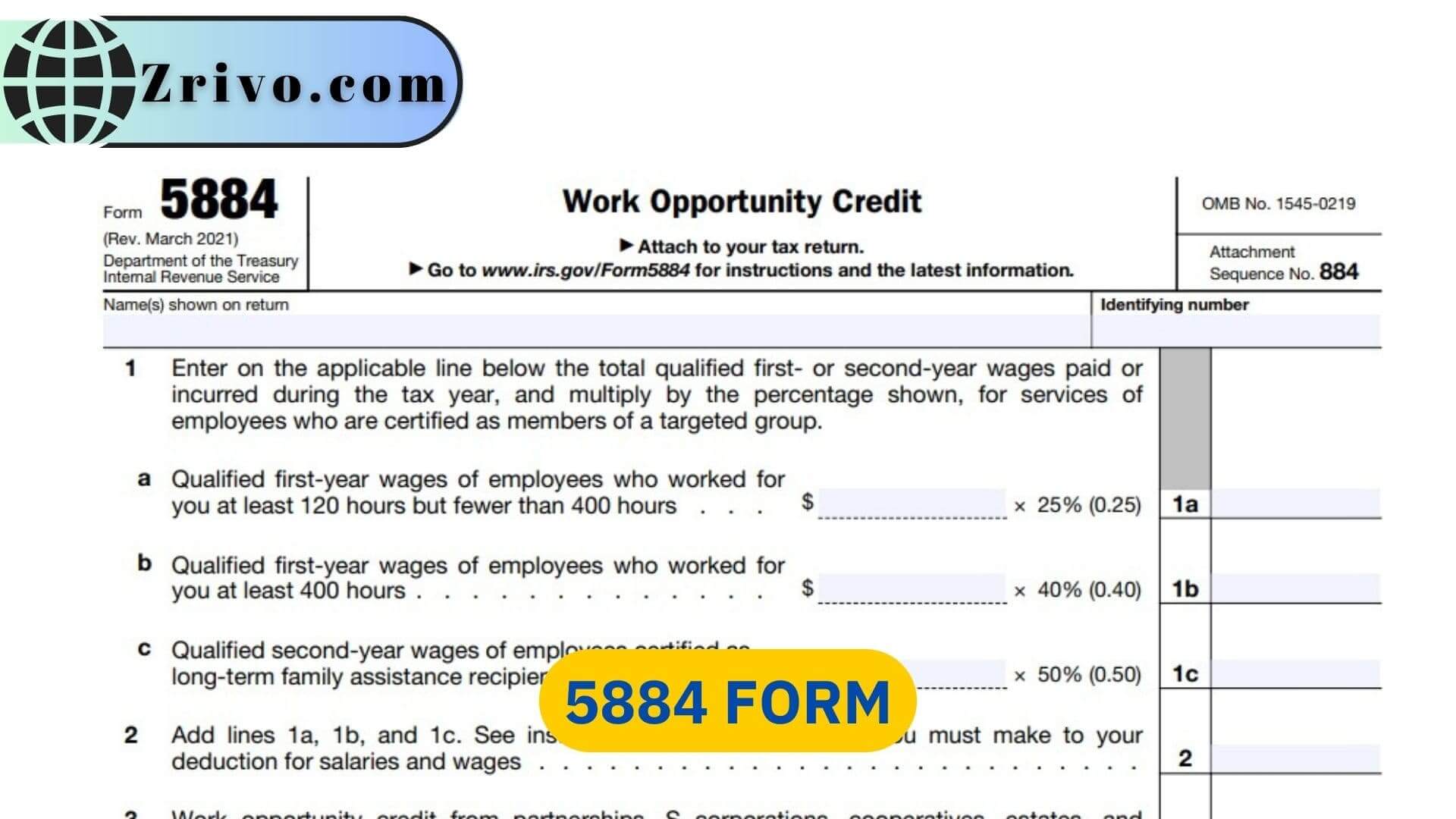

How to Calculate The Work Opportunity Tax Credit on Form 5884?

- To calculate the credit on 5884 Form, you need to determine the number of qualified wages of employees in the targeted group who worked for you for at least 120 hours. You can use either an average or a weighted average of the number of hours an employee has been employed with you in the previous year.

- In addition to the number of hours an employee has worked, you must also calculate the amount of first-year and second-year wages the business pays the employee. You must make three calculations on the form – in Part A, Part B, and Part C.

- After completing the calculations, you’ll need to enter the amount of the credit on Form 5884. This credit is then applied to your business’s income tax return and any other credits you’ve claimed on that return.

If you’re a controlled group member, the credit is divided among all members in proportion to the first-year wages they contributed to your business. For example, if the largest first-year wage contributor was a partner, that member’s share of the credit should be entered on Form 5884, and the rest of the members should enter their shares on separate forms. In addition to Form 5884, you must file Form 3800 for any other claims you have made for general business credits. You will also need to file Form 8861 if you are a controlled group and the members proportionately contributed the first-year wages of the group.