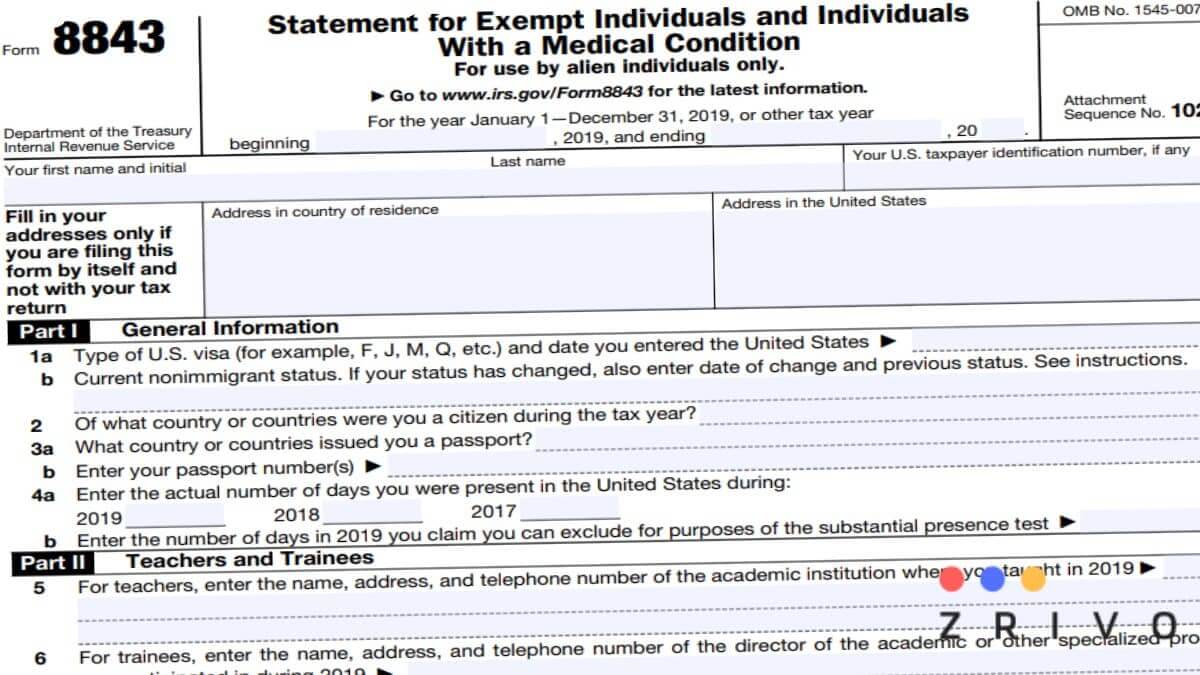

8843 Form 2023 - 2024

Contents

This is an information statement, not a tax return. You will file Form 8843 to show basis of your claim to exclude days present in the country for substantial presence test if you’re were an exempt individual or unable to leave the U.S. due to medical reasons.

On Form 8843, fill out the part that applies to you. There are a total of 5 parts on Form 8843. These are as follows.

- General Information

- Teachers and Trainees

- Students

- Professional Athletes

- Individuals With a Medical Condition or Problem

What’s the purpose of Form 8843?

Form 8843 works as an information statement for resident and nonresident aliens. If you are required to file a federal income tax return, you must file attach Form 8843 to it. If you have no income or exempt from filing a federal income tax return, only file Form 8843 to the IRS.

How to file Form 8843?

You can file Form 8843 on paper and mail it to the IRS or file it with an e-file provider. If you aren’t required to file a tax return, we suggest filling out an 8843 below and mail it to the IRS. No need to pay for an e-file provider as you aren’t required to file a federal income tax return.

On the other hand, if you’re going to prepare a tax return, it’s best to do it with an e-file provider.

Fill Out Form 8843 Online 2023 - 2024

Click on the boxes you need to enter your information on Form 8843. Upon filling out the part(s) you need to, print out a paper copy and sign and mail it to the IRS. The above version of Form 8843 is only for those who are going to mail a paper copy to the IRS.

Form 8843 Mailing Address

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

Deadline to file Form 8843 is normally June 15. However, if you’re filing a tax return, June 15 is too late. So, you must file and attach Form 8843 to your tax return by April 15.