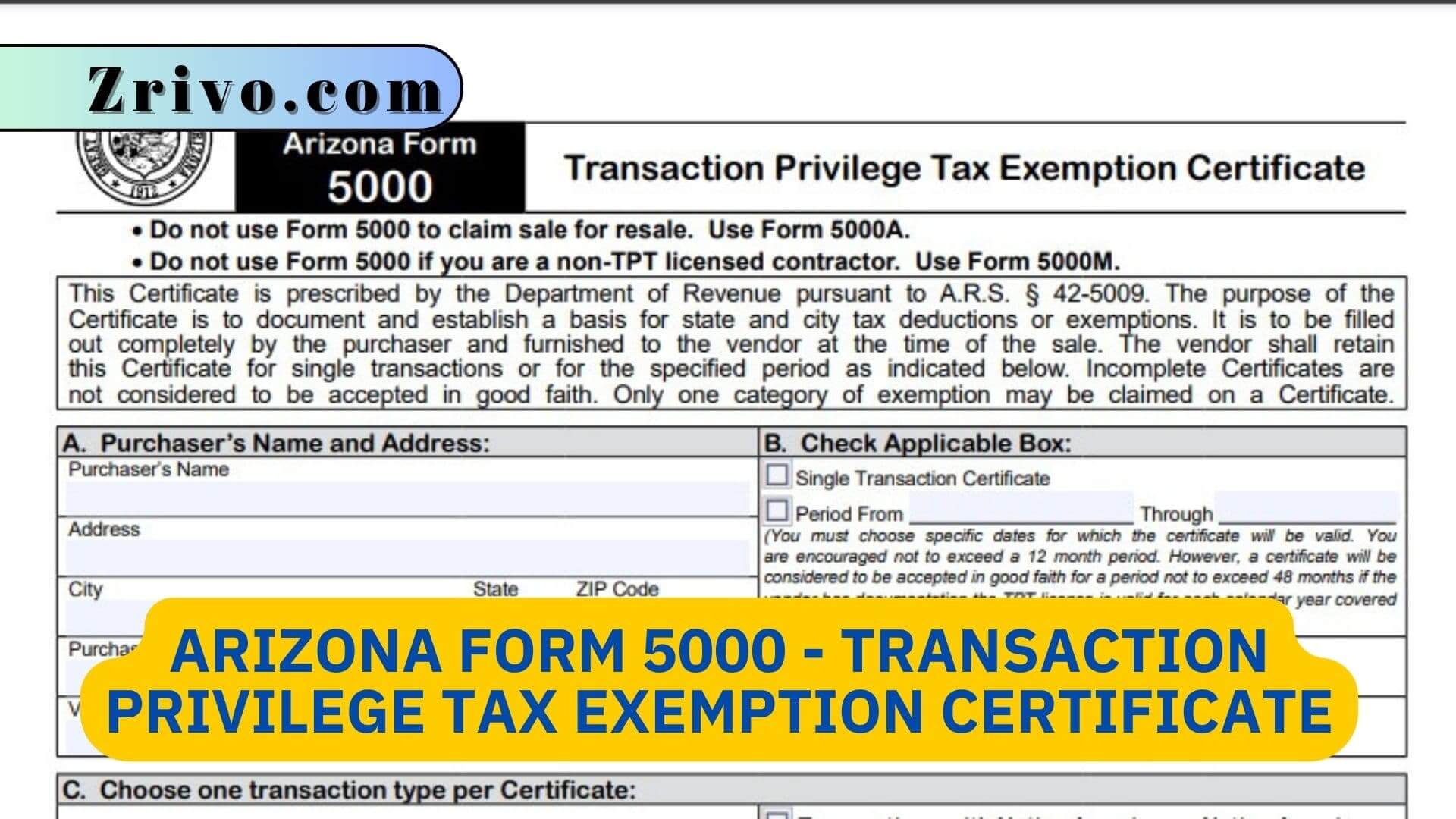

The Arizona Department of Revenue uses Arizona Form 5000 to document a taxpayer’s sales tax exemption. The form is used for purchases of tangible personal property that will be sold for use or resale where the buyer is exempt from paying sales and use tax. The form can be used for a single transaction or for multiple transactions over a specific period.

There are four types of transactions that can be documented on this form. The first is one with a business. This type of purchase requires the purchaser to provide their state privilege tax number, tax license number, and a description of the nature of their business. The second type of purchase is one with a Native American. This type of purchase requires the purchaser to identify themselves and their tribal business or organization.

The final type of purchase is with a government unit or certain qualified health care institutions. The form must be completed by the department making the purchase and provided to the vendor before or with the purchase. Arizona recently updated its income tax withholding tables, and employers should review the new state W-4 forms for employees.

How to Fill out Arizona Form 5000 TPT Exemption Certificate?

If you are a government contractor or business making purchases for resale, you may be exempt from transaction privilege tax (TPT). To prove your exemption, you need to provide your vendor with an Arizona Form 5000. The form is also known as a resale permit, reseller license, or tax exemption certificate. The certificate should be filled out completely and signed by the appropriate individual. It should include the reason for the exemption and the statutory citation. It is also important that the date of the certificate be clearly indicated.

Arizona Form 5000 consists of several sections that you must complete to make your case for the exemption. The first step is to describe the purchase. This must be done in detail to convince the TPT tax authority that you are making a legitimate purchase for resale. Then, you must list the reasons why you are exempt from TPT. The first listed reason concerns sales made to commercial enhancement districts. The next three reasons concern specific kinds of manufacturing operations.

Once you have completed the form, submit it to your TPT office. Be sure to keep a copy for your records. You should also verify the form using an eSignature solution. This will boost your document security and help you stay compliant with state regulations.