The Consumer Price Index (CPI) is the most widely used inflation indicator. It is closely watched by policymakers, financial markets, businesses, and consumers. It also is a key measure for calculating cost-of-living adjustments to federal benefits. The CPI is based on prices for a broad range of goods and services, including food, shelter, and transportation. It is calculated by weighing the prices of these items in proportion to their share of recent consumer spending. It adjusts for changes in product quality and features as well as factors such as the substitution effect, where consumers shift their purchases away from products that are rising in price on a relative basis.

CPI is constructed each month using a weighted-average basket of items that represent American consumers’ typical everyday purchases. These baskets are based on a survey of American families called the Consumer Expenditures Survey conducted by the Bureau of Labor Statistics (BLS). Each item in the basket is assigned a percentage weight that reflects the price’s importance to the average consumer. Changes in the price of chicken or tofu have a greater impact on the CPI than increases in the cost of apples. The CPI also includes a component that measures the cost of shelter. This component includes the rents for owner-occupied housing that account for about a third of the total price change.

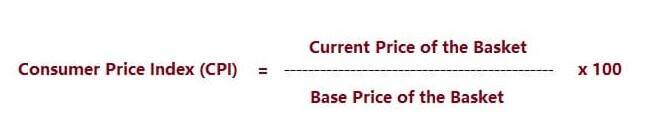

How to Measure Inflation with CPI?

the CPI is an important tool for measuring inflation and assessing changes in the cost of living over time. However, it is not without its limitations, and economists use other measures of inflation, such as the GDP deflator and the PCE price index, to supplement their analysis. Here are some ways in which the CPI is used to measure inflation:

- The CPI measures the overall price level, which can help policymakers, businesses, and consumers make informed decisions about spending, investment, and monetary policy.

- The CPI is used to adjust income levels for inflation, such as wages, salaries, and government benefits. This ensures that individuals’ purchasing power remains the same even as prices increase.

- The CPI is used to index many types of contracts, such as rental agreements, pensions, and insurance policies. This ensures that payments keep pace with inflation and that parties are protected against the erosion of purchasing power.

- The CPI can be used to compare prices across different time periods, allowing economists to analyze inflation trends and make forecasts about future inflation rates.

- IThe CPI is used for international comparisons of inflation rates, allowing policymakers and businesses to compare the cost of living and the level of economic development across countries.