Form 1310 Instructions 2023 - 2024 %category%

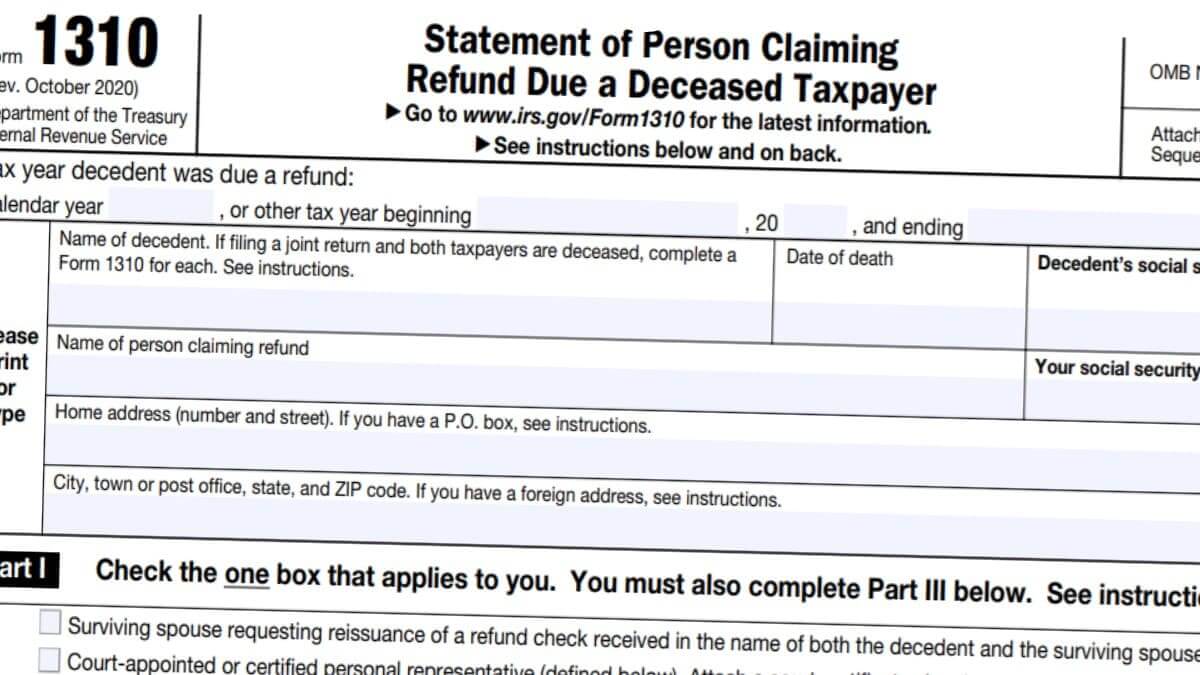

Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer is the Internal Revenue Service tax form used for providing the agency with information for taxpayers that are claiming the tax refund of a deceased individual. It’s a simple tax form that doesn’t need much explanation but, minor errors are always happening that cause further delays. If you’re new to Form 1310, here is everything you need to know about filing it.

Part 1 of Form 1310

Check either one of the boxes that contain the following information. You cannot check more than one box.

a. You are a surviving spouse requesting the re-issuance of a tax refund check received in the name of both the decedent and the surviving spouse.

b. You are the court-appointed or certified personal representative. If you’re someone that’s appointed by the court, attach the court certificate showing your appointment.

c. You are someone other than the above, claiming the decedent’s tax refund.

Part 2 of Form 1310

This section of Form 1310 is only filled out by those that checked the Box(c).

Answer Yes or No to the following questions on Form 1310.

- 1. Did the decedent leave a will?

- 2a. Has the court appointed a personal representative for the estate of the decedent?

- 2b. If you answered no to 2a, will one be appointed?

If you answered Yes to 2a or 2b, the personal representative must file 1310.

- 3. If you’re the person claiming the refund, will you pay out the tax refund according to the laws of the state where the decedent was a legal resident?

If you answered no to 3, you must submit a court certificate showing that your appointment as the personal representative or other evidence that supports you are entitled under state law to receive the refund. In short, you can receive this if you’re the personal representative of the decedent.

After completing the above – again, Part 2 is only filed by those that aren’t either a. or b. in Part 1 – you can sign Part 3 and submit the form to the Internal Revenue Service.

Form 1310 mailing address

Mail Form 1310 using USPS. Do not use Private Delivery Services such as FedEx, UPS, etc.

Put Form 1310 in a large enough envelope and mail it to the address the original tax return was filed. If you or the decedent filed an electronic return, use the 1040 mailing address to submit the 1310.