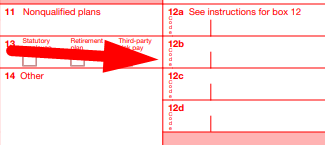

Form W2 not only reports wage, salary, and other compensation paid to employees but other forms of payments as well. In Box 12 of Form W2, employers can report other forms of payments made to employees. The most common use of Box 12 is for employee reimbursements for business expenses.

The Box 12 code for the employee reimbursements is “L”. This is the Box 12 code for employee reimbursements. Under the current tax code of the United States, this is known as the Substantiated Employee Business Expense Reimbursements.

There is no specific order that you need to enter the Box 12 codes. You can simply go ahead and enter the “L” in any order, but make sure to enter it on the left side and the money amount on the right. This is how you report employee reimbursements on From W2.

The reason why it must be reported separately from wages is that reimbursements aren’t taxable and are indirect business expenses. The amount entered on Box 12 with the code “L” is also deductible for employers.

As for what needs to be reported here in terms of the type of reimbursements, everything counts. If an employee of yours paid for something and it’s a business expense such as gas and you reimbursed the employee for this expense, it must be reported on Box 12.

It also must meet the accountable plan reimbursement rules. The rules for reimbursements whether you report it on Form W2 or not is the same. Learn more about it employer reimbursement rules for all types of reimbursements including mileage.

One thing to note here is that if an employee of yours received excess reimbursement and the expense was substantiated, the employee must return the excess amount. If it isn’t returned, you can then forward it to the employee’s wages and report it on Box 1 added with the wages.