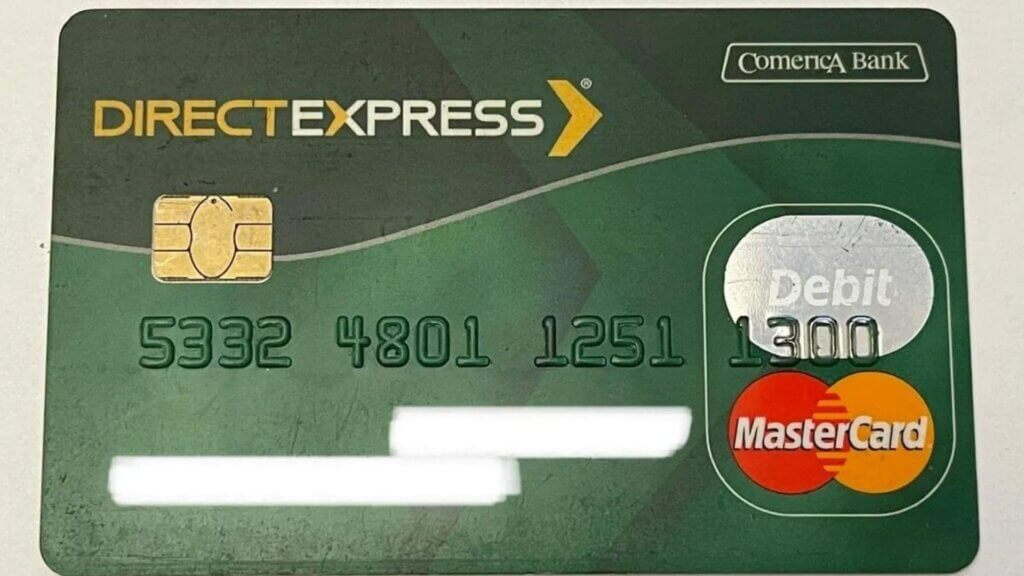

The Direct Express card is a safe and convenient prepaid debit card program designed for beneficiaries of government benefits, including Supplemental Security Income (SSI). Operated by the U.S. Department of the Treasury and Comerica Bank, this card allows individuals to receive and access their benefit payments without the need for a traditional bank account. The Direct Express card is an electronic payment method for government benefits, providing beneficiaries an efficient and secure way to receive their payments. It was established to cater to individuals who do not have bank accounts or prefer an alternative to paper checks.

To be eligible for a Direct Express card, you must be a recipient of federal benefits, such as SSI or Social Security. Individuals who already have a bank account or credit union account that can receive direct deposits are not eligible for the card. If you are approved for SSI, you will be automatically enrolled in the Direct Express card program. There is no need to apply separately. If you are already receiving SSI but have not been automatically enrolled in the Direct Express program, you can request a Direct Express card by contacting the Social Security Administration (SSA) or visiting their official website.

The card eliminates the need for beneficiaries to cash paper checks, providing a more convenient and accessible method for accessing their benefits. It offers enhanced security measures, reducing the risk of theft or loss associated with paper checks. The card allows individuals without a bank account to receive their payments electronically without the need for traditional banking services. The card is accepted anywhere that Mastercard debit cards are honored, making it widely usable for various transactions.

How to Activate the Direct Express Card?

Upon receiving your Direct Express card in the mail, you will need to activate it before use. The activation process is simple and involves the following steps:

- Call the Number: Dial the toll-free number provided on the card. Follow the automated instructions to activate the card.

- Select a PIN: During activation, you will be prompted to choose a Personal Identification Number (PIN) to secure your card for ATM withdrawals and other transactions.

How and Where to Use the Direct Express Card?

The Direct Express card can be used for various types of transactions, both in-person and online:

You can use the card to make purchases at any retail location where Mastercard is accepted. Simply swipe or insert the card at the terminal, and the purchase amount will be deducted from your card balance.

The card can be used to withdraw cash from ATMs displaying the Mastercard logo. Be aware that fees may apply for certain ATM transactions.

The card can be used for online purchases, similar to any other debit card. Enter the card details, and the amount will be deducted from your card balance.

You can set up automatic payments for recurring expenses, such as utility bills, by providing the card details to the billing company.

How to Check the Direct Express Card Balance?

To stay informed about your available balance and transaction history, you have several options:

Sign up for a free online account at the Direct Express website to check your balance, view transactions, and manage your card preferences.

Download the official Direct Express mobile app from the App Store or Google Play Store. The app allows you to access account information and receive balance alerts on your mobile device.

Call the toll-free customer service number on the back of your card to check your balance and hear recent transaction details.

Treat your Direct Express card like cash and keep it secure. Report any lost or stolen cards immediately to prevent unauthorized access to your funds. While many services are provided without fees, some transactions, such as ATM withdrawals or balance inquiries at out-of-network ATMs, may incur charges. Familiarize yourself with the fee schedule provided with the card. Periodically review your transaction history to ensure there are no unauthorized charges on your card. For added security, consider changing your PIN periodically and avoiding easily guessable numbers.

If you have questions or encounter any issues with your Direct Express card, you can contact the customer service department by calling the toll-free number on the back of your card. The customer service representatives are available to assist with balance inquiries, transaction disputes, and any other concerns related to your card.