New York School Tax Relief (STAR) Program

New York's school tax relief program, STAR, provides homeowners with a property tax reduction.

The School Tax Relief (STAR) program offers property tax relief to eligible homeowners in New York State. STAR benefits are available as an exemption or a credit. New York property taxes are some of the highest in the nation, and the STAR program helps to blunt the impact by giving residents rebates on their school property tax bills. The state recently changed how it delivers these property tax breaks, deciding four years ago to switch from a deduction on school-tax bills to a rebate check sent each fall to homeowners. This new method has sparked confusion among homeowners who aren’t sure where they stand on the STAR process, with some switching to the credit while others remain on the exemption. The New York STAR Program is governed by section 425 of the Real Property Tax Law. The state finances the STAR program, and homeowners need only to register once. After that, the state will send them a STAR check each year.

New York STAR Eligibility

The STAR credit is available to homeowners whose combined household income for all owners and resident spouses is $500,000 or less. Homeowners can also choose to receive Enhanced STAR, which provides a larger tax reduction. Enhanced STAR is available to seniors age 65 or older with incomes of $86,300 or less. In order to be eligible for STAR, the property must be owner-occupied and the homeowner’s primary residence. A married couple may only claim a single property for the STAR benefit, even if they own several properties. Corporations, partnerships, and LLCs are not eligible to receive the STAR benefit.

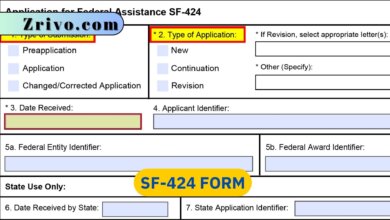

New York STAR Credit Application

The STAR program has two parts: BASIC STAR and ENHANCED STAR. If you are eligible for Enhanced STAR, you must file an application or renewal each year. You also need to submit an income verification application to New York State. These applications can be found online at the STAR Application and Renewal page. Normally, STAR exemption savings would be reflected on your school tax bill. However, if you switch to the STAR credit check program, the value of your STAR savings can never exceed the value of the rebate check.

New homeowners should apply directly with New York State Department of Taxation and Finance (DTF) instead of applying with their assessor. This is because DTF now administers the STAR program directly, and it is more efficient than having local assessors handle the exemptions. Homeowners who already receive a STAR property tax exemption on their property taxes do not need to re-apply for the rebate check. However, you can still renouce your STAR exemption if you wish to change to the STAR credit check. You must renouce your STAR exemption by May 2 of the year in which you want to start receiving the credit check.