Unemployment benefits typically replace a proportion of the worker’s previous earnings and are only available to those who have worked for a specified period of time and meet other conditions. The UI system is generally run by states but is overseen by the federal Department of Labor. States are able to set their own eligibility criteria and benefit levels, though they must meet minimum federal requirements. During recessions, when state unemployment insurance trust funds run low, the federal government transfers money to those states through a program called the Reed Act. This additional funding helps offset the effects of a slowdown by shoring up workers’ purchasing power and encouraging them to spend. It can also help avert long periods of depressing unemployment. These temporary emergency federal unemployment benefits are called extended benefits.

Unemployment Benefits Amount

Unemployment benefits are a fixed amount of money you can receive weekly while looking for work. UI payments are based on your past wages, including the average amount you earned in your base period, and typically range from about $100 to $500 per week. Your income from UI benefits is taxed. States levy employer contributions to fund UI programs. These taxes are intended to be forward funded, with states building balances in their UI trust funds during periods of healthy economic growth and then drawing down those balances to support unemployed workers during local and national economic slowdowns and recessions.

In addition to UI benefits, some states offer a permanent, temporary emergency federal benefits program known as Extended Benefits (EB). These are available in periods of severe economic stress and were temporarily fully funded by the 2009 Recovery Act. EB benefits are not as generous as regular state UI benefits but can still provide a critical safety net for jobless workers and their families.

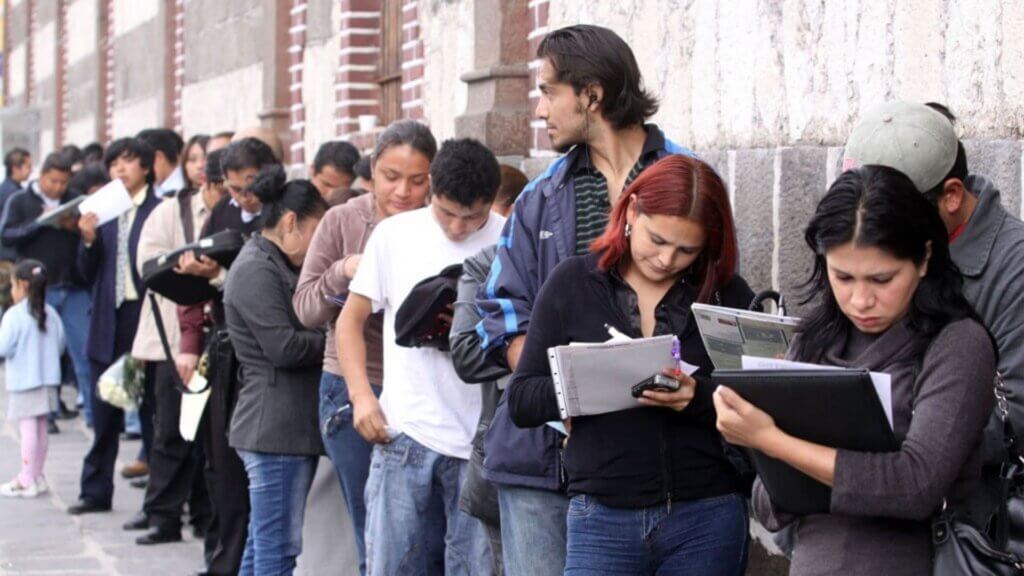

Who Can Claim Unemployment Benefits?

Generally, anyone who has worked and lost their job through no fault of their own may qualify for unemployment benefits. Qualification rules, monetary criteria, and other details vary from state to state. In New York, for example, applicants must meet both a work and earnings requirement to receive benefits. To do this, the Department of Labor will look at your wage history and wages earned in a specific period of time, called your base period. This period can be either one year or four calendar quarters (three months).

Once you are approved for unemployment benefits, the state will send you a document called a “Monetary Determination.” Each week, you must request payments online or over the phone and perform ongoing eligibility requirements like searching for work. The state will then verify your eligibility and pay you through a debit card or direct deposit into your bank account. You must claim your benefits each Sunday for the week that just ended.

Who Disqualifies From Unemployment Benefits?

Generally, you must be able, available, and actively seeking work during all weeks for which you claim benefits. You also must keep written records of your job search efforts. You are disqualified from unemployment benefits if you fail, without good cause, to apply for available, suitable work or accept such work when offered. This includes quitting a job due to a safety concern or leaving a job for other reasons that violate a company policy, such as insubordination or excessive absenteeism.

In addition, you may be disqualified if you participate in a work stoppage organized through a labor union or conducted in violation of a collective-bargaining agreement. During recessions and periods of high unemployment, the federal government has historically created temporary, wholly federally funded programs that provide additional weeks of benefits. The COVID-19 pandemic resulted in such a program. The number of workers collecting UI benefits peaked at 33 million in the week ending June 20, 2020.