A Virginia resale certificate is a document that allows you to buy goods tax-free for resale in the state of Virginia. You must present this to the vendor you are buying from, and they will verify that you meet all of the qualifications for making a sales-tax-free purchase. A resale certificate must be used only when purchasing items you sell or use during business operations.

Virginia resale certificates are required for all businesses operating in the state of Virginia. These include companies that ship products to out-of-state customers and businesses that operate e-commerce websites. They also apply to non-profit organizations that sell their products or services for less than retail prices.

In addition to being a convenient way for sellers to collect and report sales taxes, resale certificates help businesses keep track of their inventory. This helps them avoid paying overly high sales taxes on items they do not need or reselling. This can save a business money in the long run.

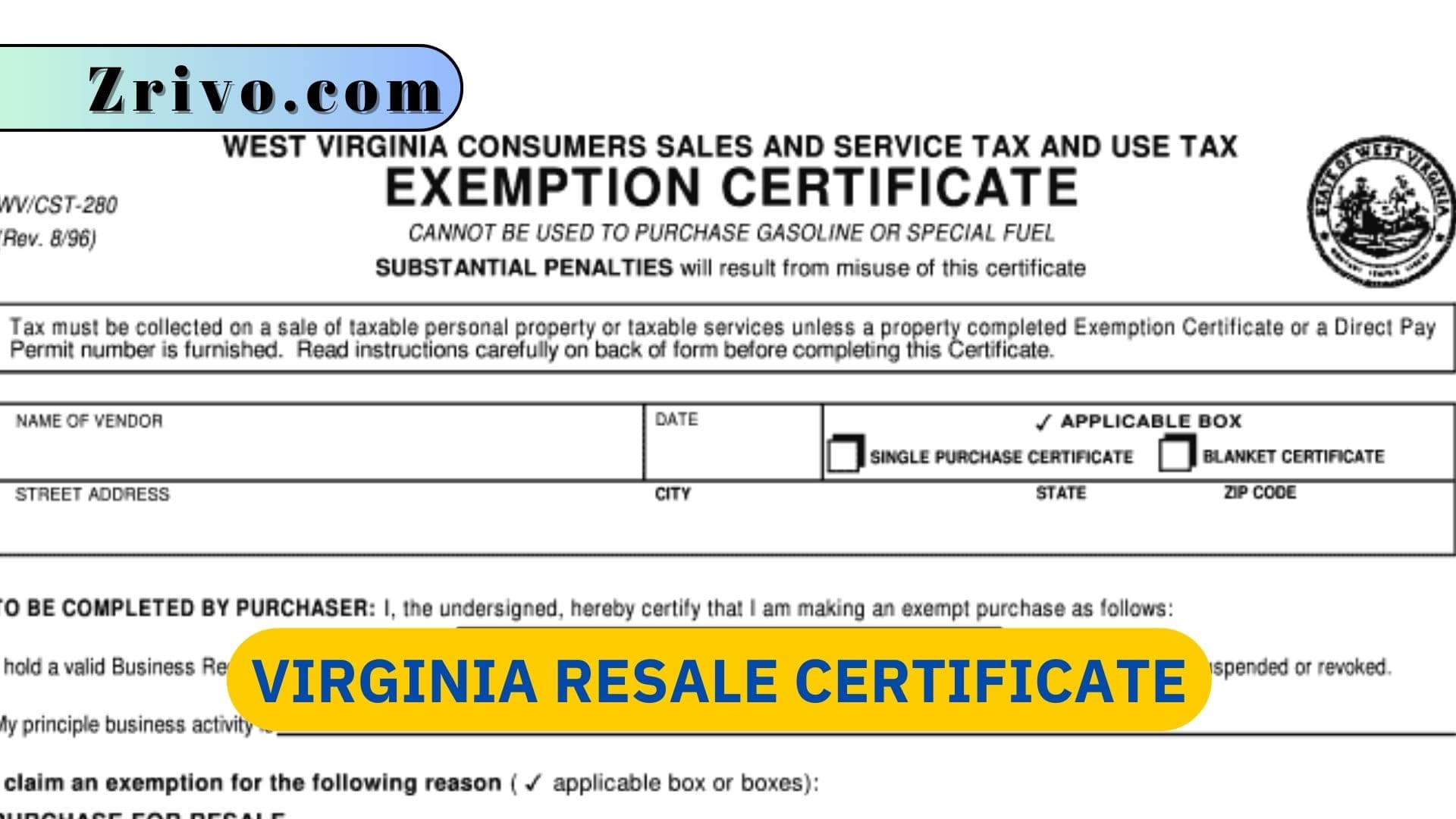

A resale certificate is an important part of a business, and it’s critical that it’s filled out correctly. It should include the name of the buyer, the seller’s sales and use tax number, a description of the goods being purchased, and a statement that the items are for resale. If the resale certificate is not accurate, it could result in penalties and other legal problems.

How to Fill Out the Virginia Resale Certificate Form?

The VA resale certificate can be filled out online or downloaded in PDF format. Whether you’re a business owner, retailer, or nonprofit, this form will help you save time and money by not having to pay taxes on your purchases. It is important to note that not all states accept resale certificates from out-of-state businesses. Check this list for more information.

After registering, you’ll receive a sales tax account number and resale certificate from the Department of Taxation. You’ll also need to provide a copy of your business’s license and proof of your Virginia tax exemption number, which will be listed on the resale certificate.

Once you’ve completed the resale certificate, be sure to keep a copy for your records. Ensure that all fields are filled out correctly and file it with the vendor you’re buying from. You can download or export the completed document, print from your browser or editor, or share it with others via a link or email attachment. You can also access the resale certificate from your dashboard, which has several features that make it easier to complete your paperwork. For example, you can add a custom theme, embed multimedia content, and add eSignatures.