W-9 Form Instruction 2023 - 2024

W-9 Form is a tax form used to request taxpayer identification information from the IRS. Here's everything you should know about the IRS Form W-9.

Contents

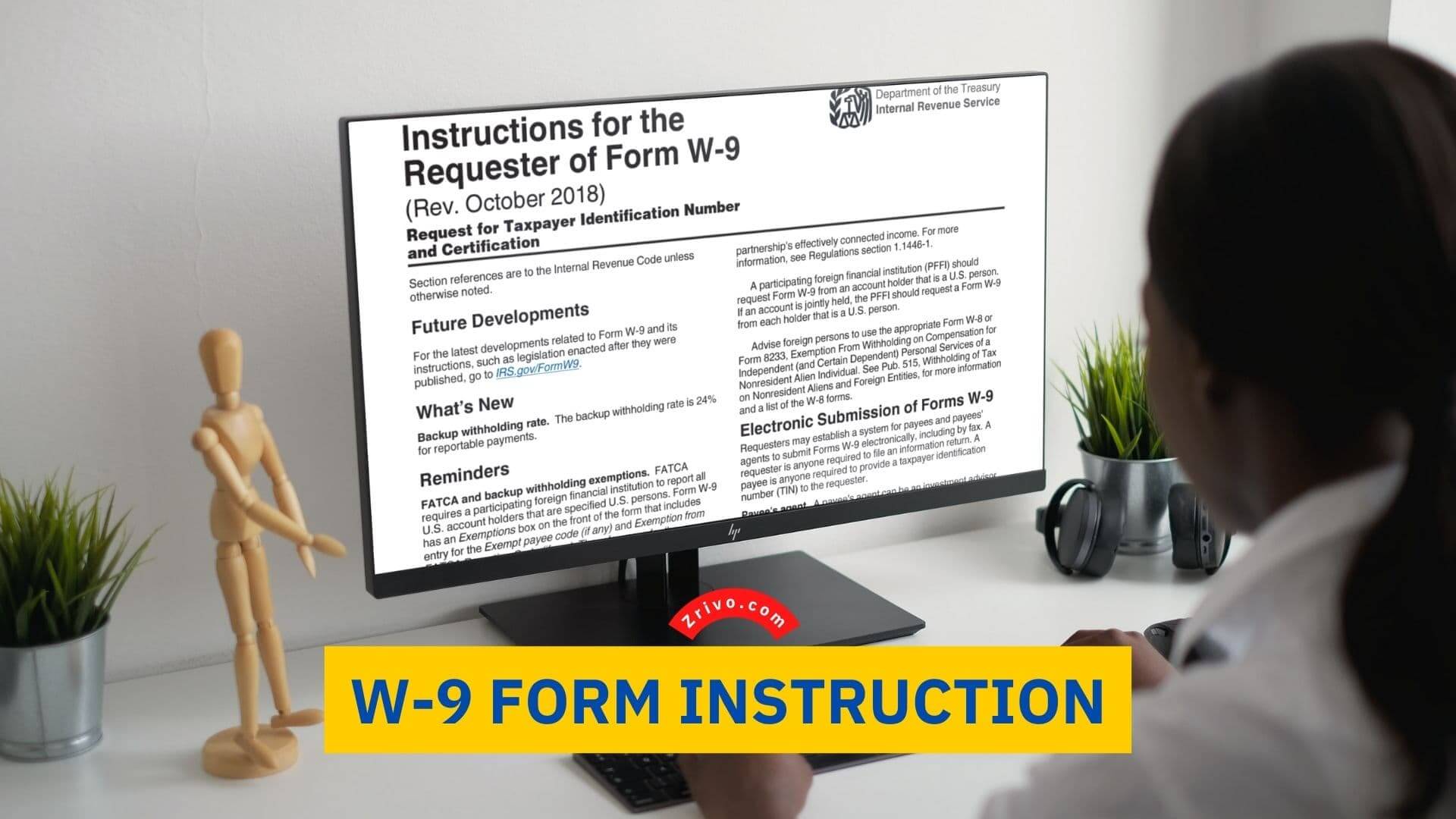

In case you are unfamiliar with the term W-9 Form, it stands for the IRS’s Request for Taxpayer Identification and Certification. W-9 Form is one of the many tax documents required by the IRS. In order to complete this form, you will need to input some information about yourself, your vendor, and your company. W-9 Form is one of the most important tax forms of the IRS. Read on to learn about the W-9 Form because you may need it for your 2024 tax return.

If you’re an independent contractor, make sure you input the name of your company and the city you live in. In addition, you’ll want to check out the “general instructions” section below the “tax identification number” box. This will help you understand everything.

You can complete a form on your own or have it done by a professional. You should be careful about what information you put in. Having incorrect information can lead to penalties or other problems with the IRS.

What is W9 Form?

Whether you are an entrepreneur, a freelancer, or a small business owner, you need to have a W9 Form. This is important because it will help you collect the correct tax identification number (TIN) and other important information.

Obtaining a W9 Form is not only a requirement for tax purposes but also a good way for businesses to track their outside staff. It includes a variety of information, such as a taxpayer identification number (TIN) and the account numbers of the individual vendors. This information can then be used to generate the 1099-MISC Form.

Form W9 is available on the IRS website and is also available in PDF format, which means you can fill it out on your smartphone or tablet.

How to Complete a W-9 Form in 2024?

In order to complete a W-9 Form, you will need to input the following:

- Your name

- Address, city, state, ZIP code,

- Date of birth, and

- Taxpayer identification number TIN

- Social Security Number SSN

- Signature.

In addition to personal information, you will also be asked to enter the information of your employer or vendor. You can choose to input your employer’s SSN or EIN. You may also want to input your vendor’s TIN. Before you fill out the W-9 Form, you will need to be sure that you have all the correct information.

Step-by-Step Instructions W-9 Form 2023 - 2024

Here are the steps to correctly fill out a W-9 Form:

- Provide Your Name: Enter your legal name on the form. This should match the name associated with your TIN.

- Business Name (if applicable): If you are filling out the form on behalf of a business, provide the legal name of the business.

- Check the Appropriate Box: Select the appropriate federal tax classification that applies to you or your business. This determines the type of TIN you should provide.

- Provide Your TIN: Enter your taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN). Make sure it is accurate to avoid potential issues.

- Address: Enter your mailing address on the form.

- Signature and Date: Sign and date the form to certify that the information you provided is accurate.

- Exempt Payee: If you are exempt from backup withholding, you must specify the reason and provide any necessary certifications.