A 1099-K may be required if you are self-employed, have more than one employer, or have various sources of income. The Internal Revenue Service should receive a report of your income and assets using this form. Observe the following points.

Venmo payments count as taxable income

You might wonder if Venmo payments are taxable income on your 1099-K tax form if you own a small business. After all, you can set up Venmo accounts for personal and business use and create separate accounts for each type of business you own. But you need to know what you’re doing before using the service. Using it for marketing is fine, but you’ll need to report the money you make to the IRS.

Venmo is a payment app that allows you to make instant online payments. It is a peer-to-peer payment system used to make purchases or reimburse your employees for business expenses. You can even set up a nonprofit account to raise money for a cause. As with any payment network, you’ll need to report your earnings to the IRS.

Venmo requires you to report your earnings if you receive $600 annually. In addition to reporting, you must keep records of your payments. This includes receipts, invoices, and expense reports. Once you meet the threshold, you’ll be sent a Form 1099-K during the tax season.

If you need to check if you’re required to report your Venmo transactions, you can check the FAQ page on Venmo. Or, you can contact them directly for updates.

Multiple sources of income

When filing your tax return, there is no such thing as a free ride. If you make money in the form of self-employment or you run a small business, you will need to report that income on your taxes. As such, there are a few tax forms you will need to have on hand and some tax questions to ask.

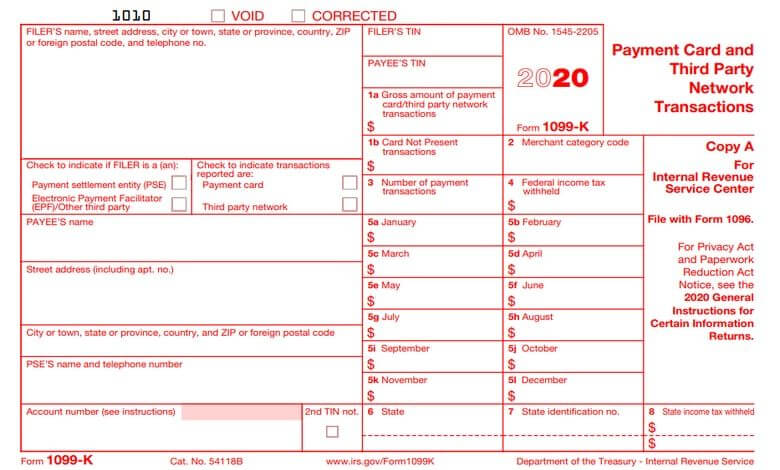

One of the most necessary tax forms to have is the 1099-K. This tax form is used to report income earned by a business from a third-party network. For instance, if you accept payment through your credit card, you will need a 1099-K.

The IRS recommends contacting the issuer of the 1099-K to see if there is a way to file your tax return that is easier and more convenient. Another option is to consult with a tax professional. These professionals can advise how to best use the information you provide.

Aside from the 1099-K, you will also need to keep track of any other tax forms you receive. You should know the following tax forms: alimony, unemployment compensation, pensions, dividends, interest, and charitable contributions. Depending on your earnings, some of these may be considered part of your overall income.

Filing a corrected 1099-K

If you received a Form 1099-K, you should check it to ensure that it includes the correct information. This form is used for reporting payments from payment settlement entities. Generally, this form is sent to businesses that receive online payments. In addition, the document is also issued for companies that sell or transfer ownership. Depending on your business, you may need to file a corrected 1099-K.

You can contact the PSE listed if you need help finding the information on your Form 1099-K. You should be able to use this information to find out what caused the issue and request a correction. Keeping copies of all correspondence with the PSE is a good idea.

The IRS has provided several guidelines for correcting a mistake on your form. These include ensuring that you report your payee’s TIN correctly, completing the correct box on your form, and using the right box on your form.

There are several reasons for errors on Form 1099-K. Specifically, your form may have an incorrect payer name, an error in the transaction amount, or an incorrect merchant category code. As a result of these mistakes, your form will show a wrong tax id, and you will need to file a corrected form.

These kinds of payments are also known as third-party network transactions or any other payment card transactions. If you’re operating an online business, your payment service provider is going to file this form so you can report income on your federal income tax return.

You will receive a Form 1099-K when the payments made to you is more than $20,000 with more than 200 individual transactions. However, certain limits apply. For example, the rest of Forms 1099 is issued if the payments made is over $600 during the course of the tax year. This applies to Form 1099-K too but only in certain situations. Learn more about the income limits for filing Form 1099-K.

Use Form 1099-K to File Tax Return

Without going in too further with the details, we can say that all Forms 1099 are used for reporting income. Form 1099-K is no exception to this, Whether the amount reported on Form 1099-K is as low as $600 or more than $20,000, it must be attached to your tax return.

If you’re filing a paper tax return, attach Form 1099-K in front of Form 1040. There is no specific order you need to staple Form 1099-K. If this is the main source of your income though, we recommend stapling it before all the other forms that report your income. For example, if you also received Form 1099-DIV for investments you made, attach it to Form 1040 behind Form 1099-K.

As for those who file electronically, you don’t necessarily need to do anything in particular. Simply, import your data to your tax return and everything will be handled from there by tax software. If the Form 1099-K is issued to you by a financial institution that works with a tax software like TurboTax, you can import your information without the need for acquiring Form 1099-K.