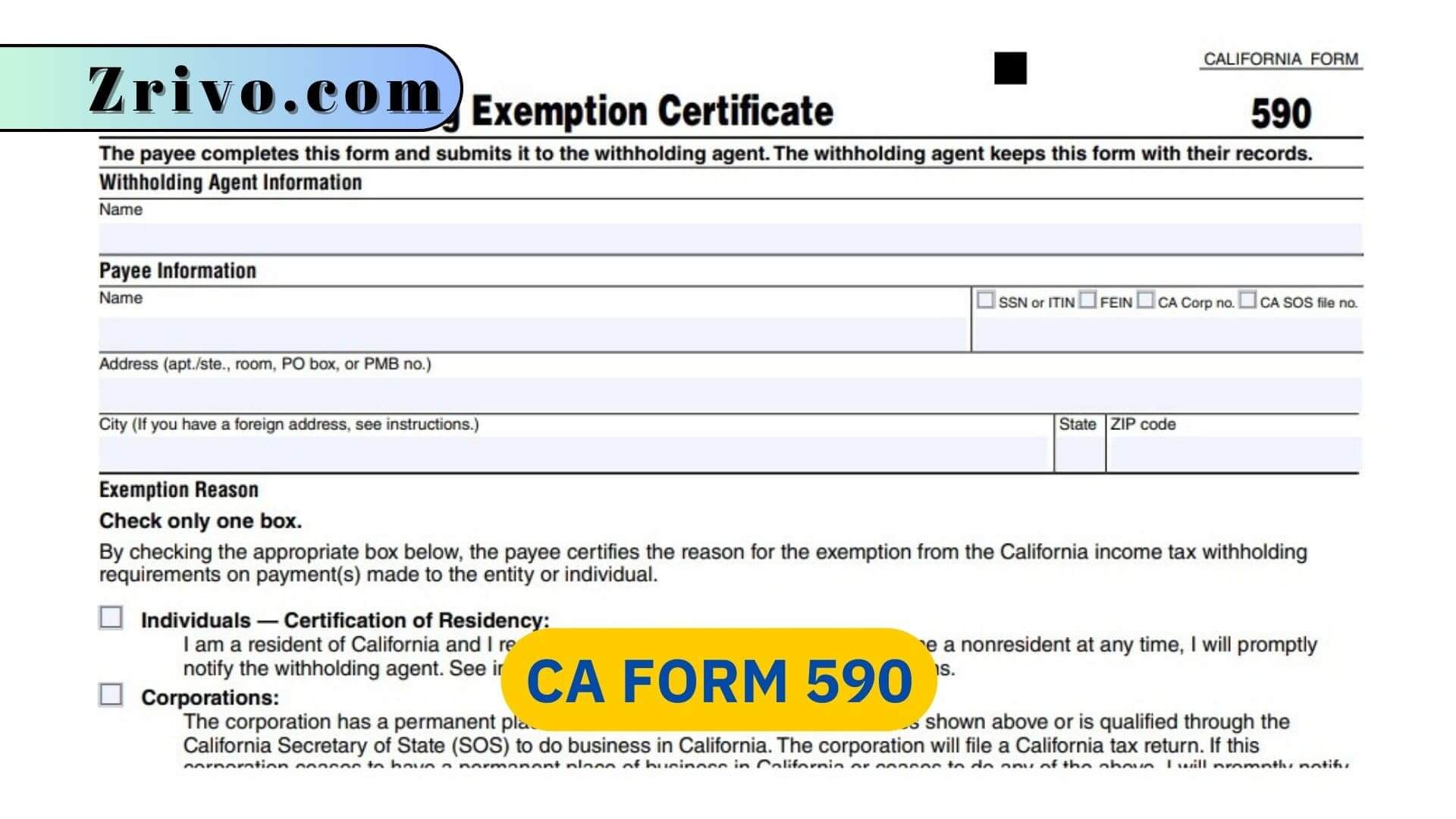

CA Form 590

If an individual or entity is exempt from California income tax withholding, they must complete CA Form 590 (FTB Form 590), Withholding Exemption Certificate.

CA Form 590 (FTB Form 590) is a Withholding Exemption Certificate that is used to certify exemption from nonresident withholding. This form is required for payments made to California nonresidents for income exceeding $1,500 per year. It is also required for pass-through entity shareholders, partners, or members who receive distributions of California source income and nonresidents who are paid prizes or winnings from California activities.

If a payee is not exempt from withholding, they must complete this form and submit it to the withholding agent before payment. The withholding agent is relieved of the withholding requirement if they rely in good faith on a completed and signed Form 590 unless they are notified by the Franchise Tax Board (FTB) that the form should not be relied upon.

The withholding amount is reported to the payee on Form 592-B, Resident and Nonresident Withholding Statement (see Related Information). If withholding is not required, the payee must retain a copy of the FTB approval letter.

How to Fill out CA Form 590?

There are a few steps to filling out CA Form 590. First, gather all the necessary information and documents. This includes personal details, income information, and tax deductions and credits. Then, complete the form. Start by entering your name and social security number in Part I. In Part II, report your gross income from all sources. Be sure to include W-2 and 1099 forms. In Part III, calculate your California taxable income by subtracting all adjustments. Then, in Part IV, list your personal exemptions (if applicable). In Part V, specify which tax credit you want to claim, if any.

Next, fill in your TIN (taxpayer identification number). You can use your SSN, FEIN, ITIN, or CA CIN. If you are a military servicemember, you can also use your PMB (private mailbox). Finally, provide your signature. You can draw your signature, type it, upload an image of your signature, or use a mobile device as a digital signature pad.

Nonresident individuals must also indicate if they have any tax liability in the state by checking one of the boxes on the form. Those who have no tax liability must check the box labeled “No Tax Liability”. Nonresident business entities must check the box that indicates their reason for exemption from withholding. You must check the “Suspended or Forfeited” box if you are a suspended or forfeited corporation.

Once you have completed the CA Form 590, submit it to your withholding agent. Nonresidents may need to submit an additional form if they wish to waive or reduce withholding. You can find these forms in the FTB’s Withholding Exemption Guidelines publication.