Form 1042-S Instructions 2023 - 2024

Form 1042-S is the tax form that tax withholding agents file. Whether you’re a business, school, institution, or any other entity, you must file Form 1042-S for the income paid to a nonresident alien.

It’s similar to information returns like Forms W-2 and 1099. You must file 1042-S with the Internal Revenue Service and the recipient. The nonresident alien who received US-sourced income that’s subject to federal income tax withholding, the recipient, needs this tax form to fulfill further tax obligations, such as filing Form 1040-NR.

For nonresident aliens

If you’re a nonresident alien that earned income and taxes were withheld from that income, take the 1042-S and attach it to your federal income tax return, Form 1040-NR. Do not file Form 1040 as it’s only for US individuals.

However, you may not be required to file Form 1040-NR if you didn’t engage in trade or business and you paid off all your tax liability.

How many Forms 1042-S to file?

Two copies of Form 1042-S need to be filed; one for the IRS and one for the recipient, you. As a withholding agent, you must fulfill this tax obligation by March 15. Beyond this date, you will pay monetary penalties.

Instructions to file Form 1042-S

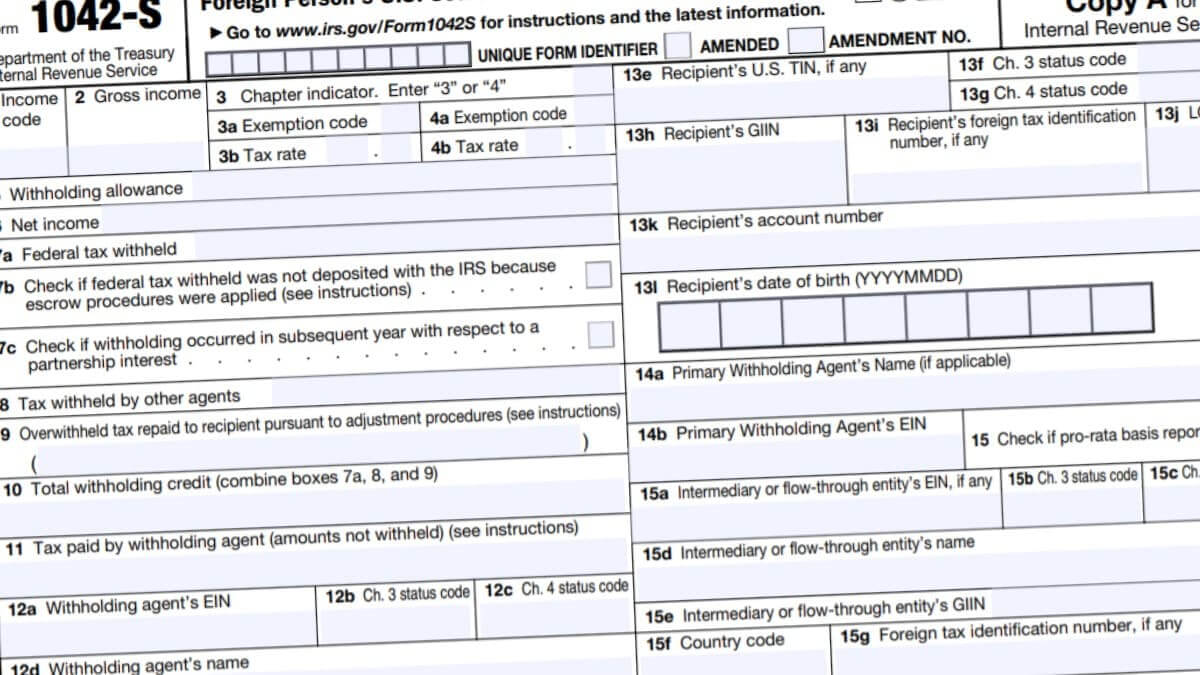

At first glance, Form 1042-S might be intimidating to file with so many boxes, but know that it isn’t. The majority of the information you’ll enter on the 1042-S is pretty much the same information but by detail.

One side of Form 1042-S is designated for the recipient, and the other is for the withholding agent. About the withholding, you will enter the following.

- Income code

- Gross income

- Withholding allowance

- Federal income tax withheld

- Net income

- Whether or not the federal tax withheld was not deposited with the IRS because escrow procedures were applied

- Whether or not the withholding occurred in the subsequent year with respect to a partnership interest

As stated, these are pretty much it when it comes to withholding information. Other than this, you will need to enter the recipient’s personal information and you, the withholding agent. This includes, but is not limited to, taxpayer identification number, GIIN if applicable, date of birth, and address.