Form 433-D

When taxpayers can’t afford to pay the amount they owe in full, applying for IRS tax relief is a good idea. One option is to enter into an installment agreement with the IRS, and this can be done using Form 433D.

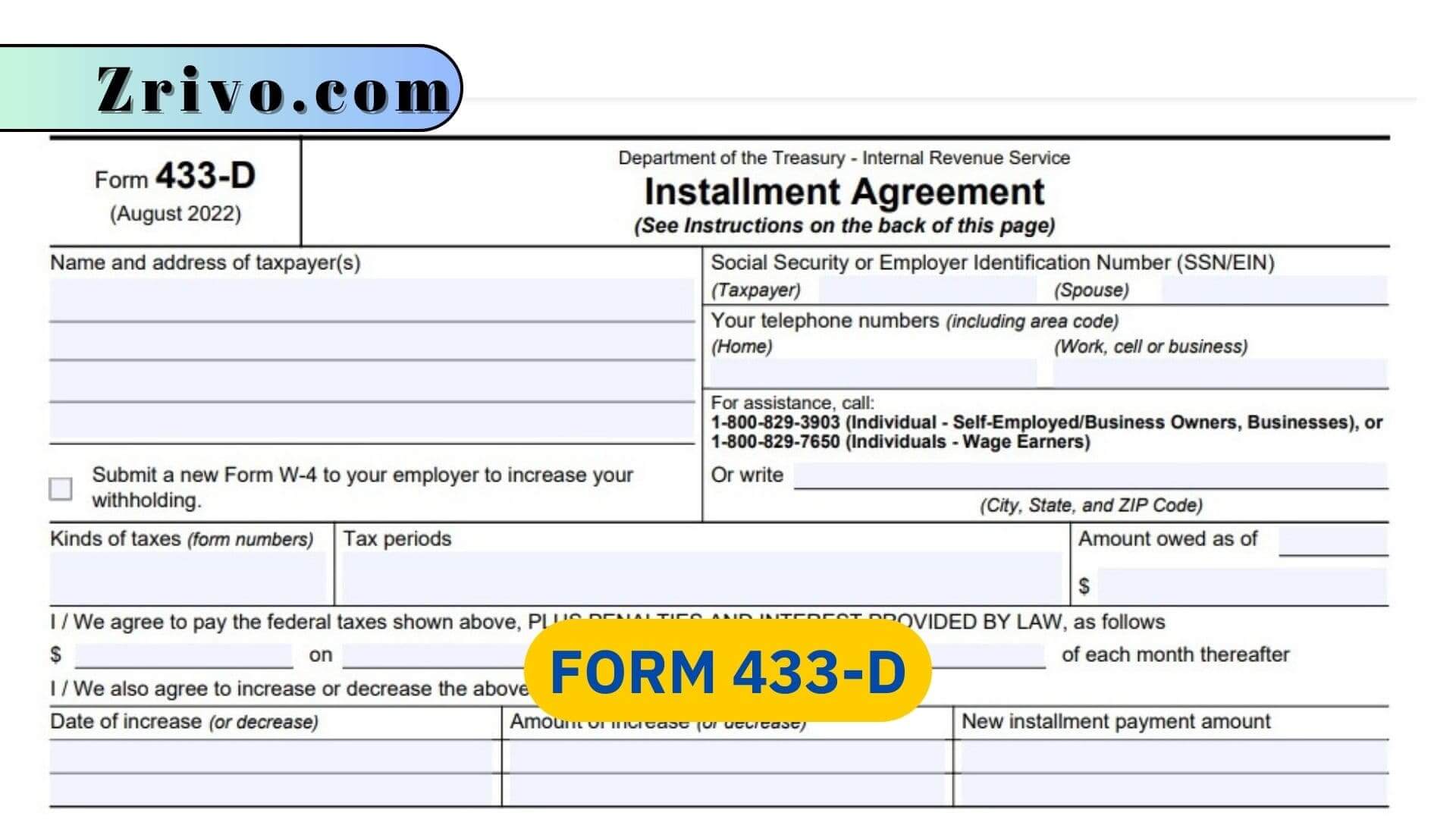

The IRS Form 433-D, also known as the Installment Agreement Form, allows taxpayers to finalize an approved installment agreement and authorize payments by direct debit. This form requires information about the individual’s current financial status and their capacity to pay their tax debt. To complete this form, taxpayers will need to provide their contact information and details about their financial situation. They’ll also need to provide their account and routing numbers and the date when they will start making payments. Taxpayers who want to use a different method of payment should also indicate this on the form.

If you are unsure where to send the form, they should refer to the instructions in the letter they received from the IRS. Once they’ve completed Form 433D with all of their information and payments, they can mail it to the IRS. In some cases, this form may lead to a streamlined installment agreement or even an offer in compromise. To ensure that they fill out this important form correctly, taxpayers can use a PDF editing tool that is efficient at form filling and other major tasks.

How to Fill out Form 433-D?

The first section of Form 433D asks for basic personal information, including the taxpayer’s name, address, and social security or employer identification number. The form also asks for the taxpayer’s spouse’s information if they are filing jointly. The next sections ask for bank account information and routing numbers to set up a direct debit arrangement to make monthly payments. The final section asks how much the taxpayer is able to reasonably pay each month. It’s important to complete the form so the IRS can verify it. Leaving any boxes blank will result in the form being returned to you for additional information. If a particular field is not applicable to your situation, you can use N/A instead.

You should also write down any future increases or decreases in your payments. For example, if you’re expecting to receive a raise in three months, you should write down that information on the second page of the form. Form 433-D will also request the balance and minimum monthly payment of all credit card accounts and bank accounts. It will also require the routing number and account number of any direct debit payments. Lastly, the form will note any increases or decreases in a taxpayer’s monthly payment that may be necessary as their circumstances change.