IRS Form 1120S Instructions 2023 - 2024

The IRS Form 1120S provides the IRS with an overview of your business’s assets, liabilities, and equity. In this article, you can find the instructions for filling out Form 1120S. We also offer tips for completing Schedule L. If you need additional assistance, contact your tax professional.

Before completing and filing IRS Form 1120S, it is important to review the instructions thoroughly. This 40-page document contains a lot of information and references to other resources, so you will want to go through each section before preparing and filing the tax return. You should not skip a section because it may have a specific reference or information that doesn’t apply to your business. To avoid this problem, make sure to read the IRS Form 1120S instructions for every section before filing your return.

The first part of the Form 1120S instructions is the balance sheet. This can be pulled from your accounting software, or you can prepare one manually. This statement might have more details than Schedule L. In such a case, you should combine the balance sheet with Schedule M-1 and attach it to your tax return. Once you’ve completed Schedule M-1, you can proceed to fill out Schedule M-2, which reconciles your books with the tax return.

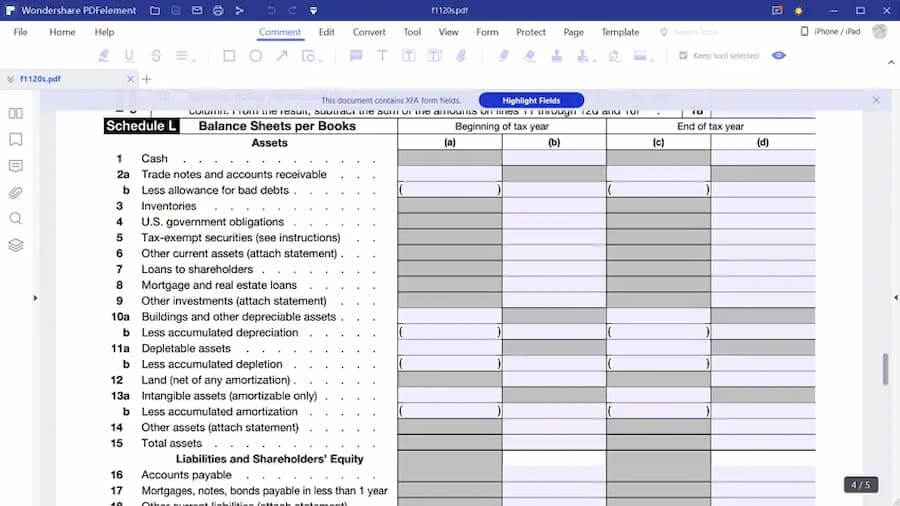

Schedule L

Schedule L of the IRS Form 1120S is the balance sheet for the corporation, which lists all the assets and liabilities of the corporation. These liabilities include accounts payable, mortgages, and loans from shareholders. Shareholders’ equity is also reported on this line. In addition, Schedule L includes information about the company’s current cash position. The information provided is essential for preparing the 1120S Form. To complete IRS Form 1120S, you must gather all the necessary documentation and prepare the balance sheet.

Line 23

Fortunately, the IRS has provided a way to skip Line 23 of IRS Form 1120S. While this line does look similar to the regular 1120, the instructions skip over it altogether. That’s fine with most taxpayers. In fact, you may even be able to complete it yourself without having any experience. The Internal Revenue Service has provided two alternatives for corporations that have very low assets and receipts. If you’re thinking about filing a return for your business, you may want to look into the options available to you.

For businesses that have less than $250K in revenue or assets, it’s possible to skip Schedule L. If you have kept good records for the previous year, filling out Schedule L should be relatively easy. The instructions are short and skimpy, so you can skip this part if you’re just starting out. After all, you’ll use the numbers from last year’s balance sheet to fill in the columns, so you’ll have no trouble getting a proper understanding of your books.

Business activity code

A business activity code is a six-digit identifier that identifies a particular type of business. This code is assigned to a specific type of business based on its primary activity.

Examples of business activity codes include retail stores, food and beverage stores, meat and poultry markets, and specialty foods and beverages. The list of available codes is available in the IRS’s North American Industry Classification System.