Form 1040-V payment voucher is one of the must-know statements for any citizen in the US. This is one of the core statements in trade, and thus, we have compiled a comprehensive guide for our readers to fully inform them. In the following sections, you can learn every single detail you need to know.

What Is a Form 1040-V Payment Voucher?

A Form 1040-V payment voucher is a statement that taxpayers send to the IRS (International Revenue Service) together with their tax return. This voucher is only submitted if you are willing to make the payment with a money order or check. Depending on where you reside, you can send your voucher to different IRS filing centers. But if you send your payments electronically, you will not have to use any Form 1040-V payment vouchers.

Who Can Submit a Form 1040-V Payment Voucher?

Any taxpayer who wants to remit their payments to the IRS with a money order or check must fill out and submit Form 1040-V payment voucher. This voucher is a must for all kinds of mailing payments to agencies. On the other hand, you can avoid filling out this form by preferring to make your payments electronically.

How to File a Form 1040-V Payment Voucher?

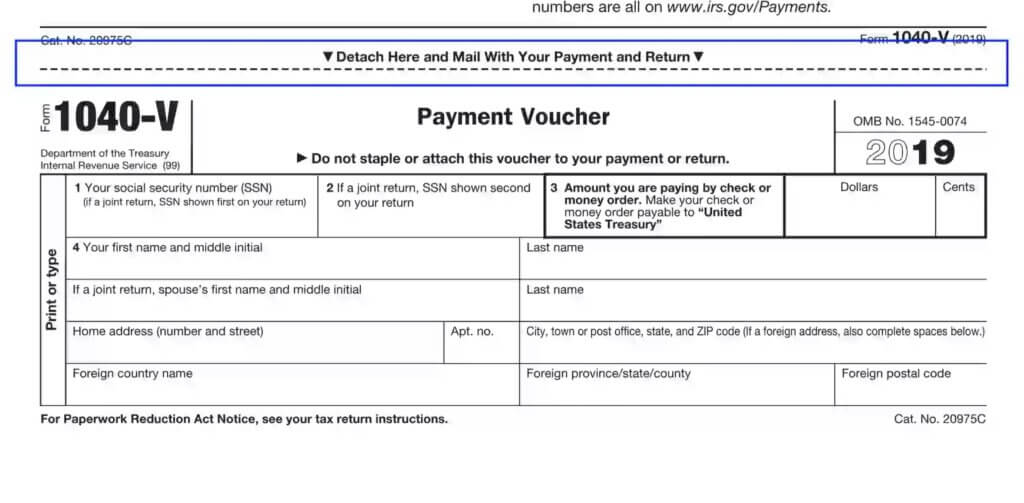

The Form 1040-V payment voucher consists of four sections. You have to write down your SSN (Social Security Number) on the first line. The second line should be filled in by those who are filling out the form for a joint return. In this section, you have to write down your spouse’s SSN.

You have to state the amount of the payment you are going to pay with a money order or check. Then finally, you need to write down your full name and address on the fourth line. It is worth noting that you have to detach the voucher at the bottom of the form and mail this piece separately.

Another important thing to remember is that the IRS doesn’t accept cash payments via mail. You need to make your payment with mail order or check. You also write the amount of the payment in $XXX.XX format to prevent any mistakes during the processing.

Where Can You Download Form 1040-V Payment Voucher?

Accessing the form 1040-V payment voucher is highly straightforward. All you need to do is visit the official website of IRS and search for the form. You can also click on this link to access the PDF version directly on the IRS website.

Where Should You Mail Form 1040-V Payment Voucher?

This depends on where you reside in the United States. However, you do not have to worry about finding these addresses since they are available on the form. Once you download the form, you can find all the available addresses where you can mail your Form 1040-V Payment Voucher on the second page of the file.

Although filing the form 1040-V payment voucher may seem quite challenging and complex for those who are going to file it for the first time, you can easily complete the operation on your own.