W4P Form 2023 - 2024

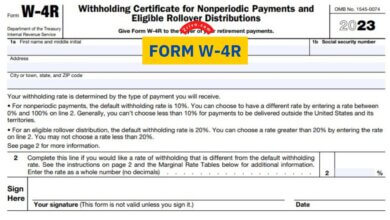

Form W4P is for letting payers know about how much tax to withhold from pensions and annuity payments. You can also claim exemption from federal income tax withholding from this income.

If you’re still working for an employer, you may want to opt for filling out W4 Form 2023. You can just enter an extra withholding amount on W4 Form 2024 and skip filling out Form W4P.

Fill Out Form W4P Online

Fill out Form W4P online to furnish the payer with the information needed to withhold the right amount of tax. If the payer doesn’t receive this and withholding is mandatory, the payer will withhold tax at the highest single rate, meaning zero allowances on Form W4P.

Those who don’t want to withhold federal income tax on Form W4P and claim exemption can leave Lines 5 and 6 blank and enter EXEMPT on Line 7.

How to fill out Form W4P?

Form W4P is a simple tax form that you shouldn’t have trouble with filling out. If you’ve filed Form W4 in the past, prior to the 2022 changes, you know allowances work. While the allowances have been removed from W4 Form, it remains on W4P.

Most taxpayers either claim one or two allowances on Form W4P. If you’re filing a joint return, claim one allowance by entering “1” on Form W4P, an additional allowance for each dependent you have. You can also claim an allowance for yourself but this may result in under-withholding taxes.

For single filers, claiming zero allowances or one allowance mostly works just fine, but if you have dependents, you may want to claim one allowance for each dependent you have.

The dependents matter because you may qualify for the child tax credit 2021 and be able to reduce tax liability by $2,000. This will help you pay less tax, therefore, to not get a higher tax refund than you should, claim allowances for each dependent that qualify for the child tax credit. The same also applies to joint filers.