W7 Form 2024

The W-7 Form, also known as the "Application for IRS Individual Taxpayer Identification Number," is a crucial document for individuals who are not eligible for a Social Security Number (SSN) but still need to fulfill their tax obligations in the United States.

Contents

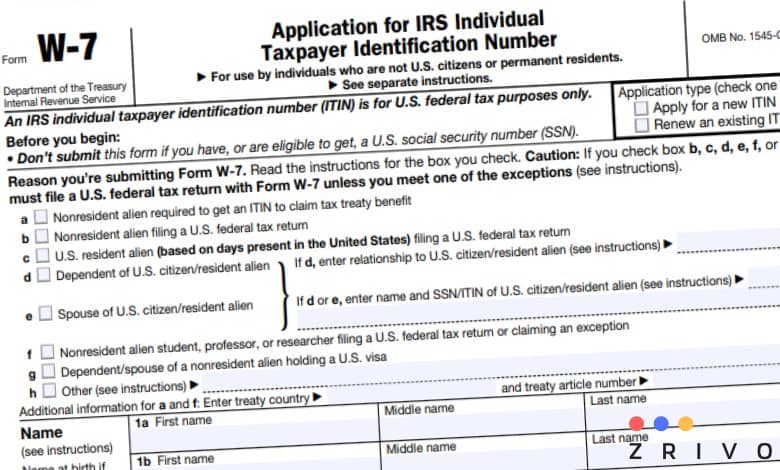

Form W7 is the application for Individual Taxpayer Identification Number (ITIN) for aliens in the United States for tax purposes. Since nonresident aliens don’t have a Social Security Number, they must have ITIN to file their tax returns. To obtain ITIN, aliens must fill out Form W7 and mail it to the IRS.

Unfortunately, the IRS doesn’t allow e-filing of Form W7 and it must be mailed to the agency. The W7 is made up of a total of six parts. On Form W7, the alien needs to provide information about the following.

- Reason for submitting a W7

- Name

- Applicant’s Mailing Address

- Foreign Address (if any)

- Birth Information

- Other Information about country of citizenship, tax ID (foreign), U.S. visa, etc.

You can follow the instructions below to fill out paper Form W7 and mail it to the IRS to apply for ITIN. You can start filling out Form W7 below. This version of Form W7 can only be mailed to the IRS. However, you can file it online. Click on the boxes you want to enter your information and start filling out. Then, use the buttons on the upper right corner to download and print out.

Instructions and mailing address can be found at the bottom of the article.

File Form W-7 online PDF

You can use the below Form W-7 online and print out a physical paper copy with the information entered on it. This is a straightforward way to file Form W-7 that doesn’t take much effort. Plus, you get to save a digital copy of the tax form you filed so in case you do something wrong, you’ll always have something to revert back to.

Start filling out W-7 below.

File Form W-7 online PDF

You can use the below Form W-7 online and print out a physical paper copy with the information entered on it. This is a straightforward way to file Form W-7 that doesn’t take much effort. Plus, you get to save a digital copy of the tax form you filed so in case you do something wrong, you’ll always have something to revert back to.

Start filling out W-7 below.

Form W7 Instructions 2024

First and foremost, you must select the reason for applying for an Individual Taxpayer Identification Number. You can select either one of the following on Form W7.

a. Nonresident alien required to get an ITIN to claim tax treaty benefit.

b. Nonresident alien filing a U.S. federal income tax return.

c. U.S. Resident Alien filing a U.S. federal income tax return.

d. Dependent of a U.S. citizen or a resident alien.

e. Spouse of U.S. citizen or resident alien

f. Nonresident alien student, professor, or researcher filing a U.S. federal income tax return or claiming an exception.

g. Dependent or spouse of a nonresident alien holding a U.S. visa.

If you select Box D which is titled as “dependent of U.S. citizen or resident alien, you must enter the relationship to the U.S. citizen or resident alien. On the other hand, Box E titled as “spouse of a U.S. citizen or resident alien”, enter the name and Social Security Number or ITIN of your spouse.

Name, Mailing Address and Birth Information

On the second, third, and fourth part of Form W7, enter the information asked.

Name

Enter your full name and your birth name if it’s different than above.

Mailing Address

Enter your U.S. mailing address. If you don’t have one, you must get one since the IRS will send you documents.

Foreign Mailing Address

Enter your foreign mailing address if you have one. On this section of Form W7, don’t enter a P.O. box since it won’t be relevant.

Birth Information

Enter your date of birth, country of birth, gender, country of citizenship.

Followed by foreign tax identification number (if any), enter the type of visa you’re holding if any, and the expiration date, whether or not you received an ITIN in the past and if you received one, enter it on 6f. Lastly, enter the name of college, university, or the company and sign the document with the date of completion.

Who Needs to File a W-7 Form?

- Non-resident Aliens: Non-U.S. citizens who earn income in the United States or engage in financial transactions that require tax reporting are often required to file a W-7 Form.

- Resident Aliens: Resident aliens who do not qualify for an SSN or have dependents who are not eligible for an SSN may also need to file a W-7 Form.

- Certain Non-immigrant Visa Holders: Some visa holders, such as students on F, M, or J visas, and their dependents, may need an ITIN to fulfill their tax obligations.

W7 Mailing Address

Once you’re done completing Form W7, you must gather additional documents and put them in a large envelope that you aren’t needed to fold any documents. To successfully submit your application, put your tax return, foreign status document, proof of identity, and your W7 in the envelope.

Form W7 Mailing Address is as follows.

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Keep in mind that it takes about 6 to 8 weeks for the IRS to issue you an ITIN. After obtaining your ITIN, you aren’t required to mail your tax return to the above address. You will use the Form 1040 mailing address just like everyone else, there is nothing in additional that you need to do. If your ITIN isn’t used on any tax return in five or more years, it will be canceled and if you don’t have a Social Security Number by then, you will have to apply for an ITIN again.