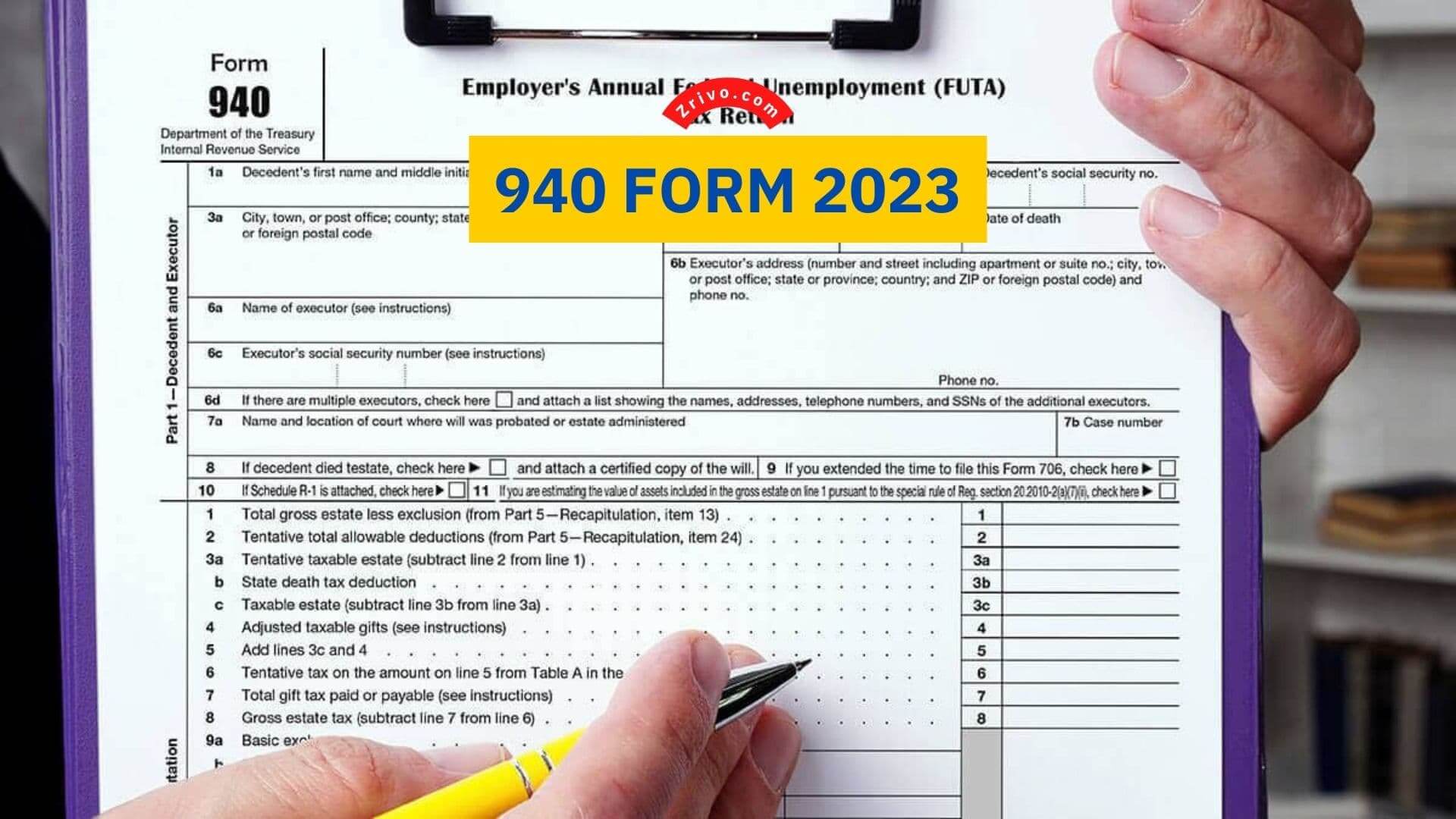

940 Form 2023

The IRS allows unemployed taxpayers to make deductions in 2023, too. Have you become unemployed recently? Then, you may want to file Form 940.

You’ll need to know the correct way to fill out the 940 Form and understand the eligibility requirements. The IRS has a new system for the tax year 2023 that makes the process much simpler. It calculates penalties for underpayments and allows you to deduct state unemployment taxes.

940 Form is an annual tax form that outlines an employer’s federal tax obligations. It also contains information on shared taxes. Like Schedule A, this form is required for employers who have employees who live in multiple states. However, some states have recently reduced the credit for state unemployment taxes that employers may receive. This is because some states have borrowed funds from the federal government to pay for unemployment benefits in their state and have not paid it back.

How to Fill Out the 940 Form?

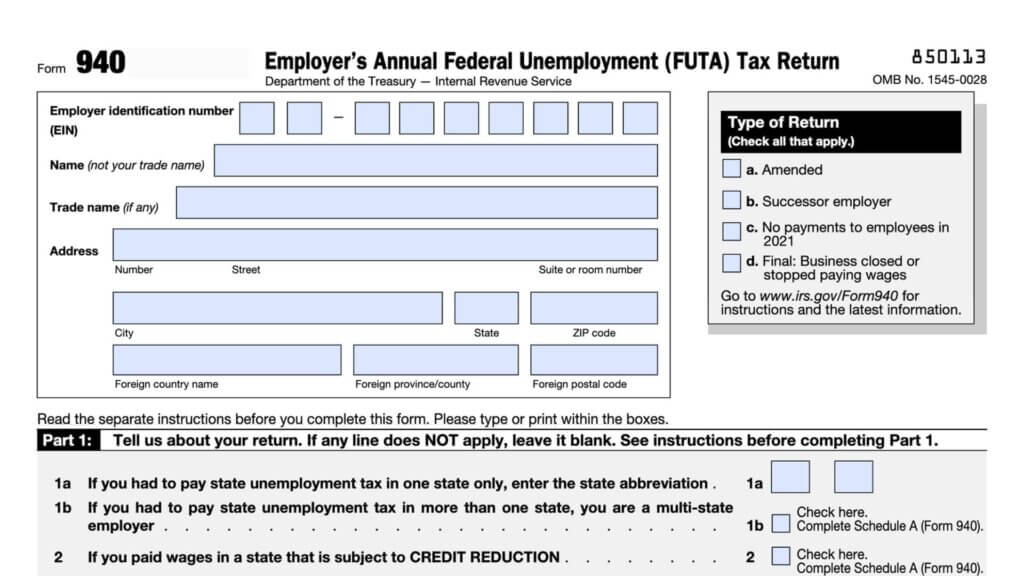

To complete the 940 Form, a business must provide basic information such as its name, address, and Employer Identification Number. A business must also have a Social Security number, or EIN, in order to receive an employer identification number. The form is divided into seven sections, each of which must be completed accurately.

- EIN ( Employer Identification Number )

- Business name or trade name.

- Address.

The first part asks you to indicate whether you are an employer in one state or several. You cannot use your Social Security or Tax Identification Number to fill out this form.

- If you’re a multi–state employer, you’ll need to fill out lines 1a and 1b to indicate which states you’re paying unemployment taxes in.

This form is important because it contains information about your employees. It’s important to keep your business information up-to-date. Make sure you have your employer identification number, company name, address, and state unemployment account number correct.

Eligibility for Form 940

You may be eligible for a tax credit if you are in one of these tax-free states. For instance, if you are in California, you can claim a credit of up to 5.4% of your FUTA taxable wages. In other states, the credit is limited to 0.6%.

If you meet the filing requirements for 940 Form, you should not forget that it must be filed between January and March of the year following your calendar year. This form is generally required to be filed electronically. It’s for your own good to keep yourself updated because, the IRS makes changes to the formats of the forms they use, too often these days.