W-2 Explanation

Form W-2 is a simple enough tax form used for reporting income paid to employees and taxes withheld. Those who are looking for an explanation to Forms W-2 shouldn't get any worries.

Contents

A W-2 explanation is essential for anyone working for an employer. It will help you to know the information on the document, as well as how to correct any mistakes you make. This article will walk you through some of the most common mistakes to avoid on a W-2.

Box 1

Box 1 on your Form W-2 is the amount of compensation taxable for federal income tax purposes. This includes wages, tips, and other compensation. It also has taxable fringe benefits, such as taxable moving expenses and taxable group-term life insurance. However, box 1 excludes taxable wages earned through elective deferral programs.

Box 3 contains information on total wages subject to Social Security taxes. If your real wages are less than $106,800, you should report them in both boxes. The limit is called the Social Security wage base.

Box 4 shows how much social security tax has been withheld from your pay. Some of your wages may be subject to social security and Medicare taxes. In these cases, the number of paychecks in box three may be lower than the number of stipends in box 1.

Box 5 contains a taxable list of wages for both Social Security and Medicare. These may include cash bonuses and prizes.

Common mistakes to avoid on a W-2

When preparing your Form W-2, you want to ensure it’s accurate. A mistake on your tax form could cause you to lose money or delay the refund process for your employees. However, you can prevent these errors from happening. Here are a few common mistakes to avoid on a Form W-2.

First, you should make sure you use the correct font type. Using the wrong kind of ink will distort the information you’re trying to display. The most important rule of thumb is to use black ink. It would be best to be careful when folding or stamping the form.

Next, be sure to include the most important details first. For example, you want to ensure you get all the checkboxes for your employee’s retirement plan. If you leave this box blank, you’ll miss out on an error.

Finally, be sure you’re using the proper format for your employee’s name. This is especially important if you have a large number of employees. Your employer’s name should be in the same format on all your forms, including the Form W-2.

Correcting a mistake on a W-2

If you have an error on your W-2, you may need to contact your employer to correct it. You must report any errors on your form to avoid fines or delays in filing your taxes.

An employer can correct an employee’s Social Security number, name, and address on the form. The Social Security Administration requires an employer to correct a mistake on a W-2 before it is accepted.

An employee’s health coverage is coded as “DD” in box 12 of the form. This can be corrected on Form W-2c.

There are several reasons why you need to make a W-2 correction. These include incorrect information on a retirement plan, a spelling mistake, an address, or a number mistake.

In some cases, you’ll need to purchase a new form. You can either get a new one from your company or order it online. However, you should not use a new form to correct a tax return.

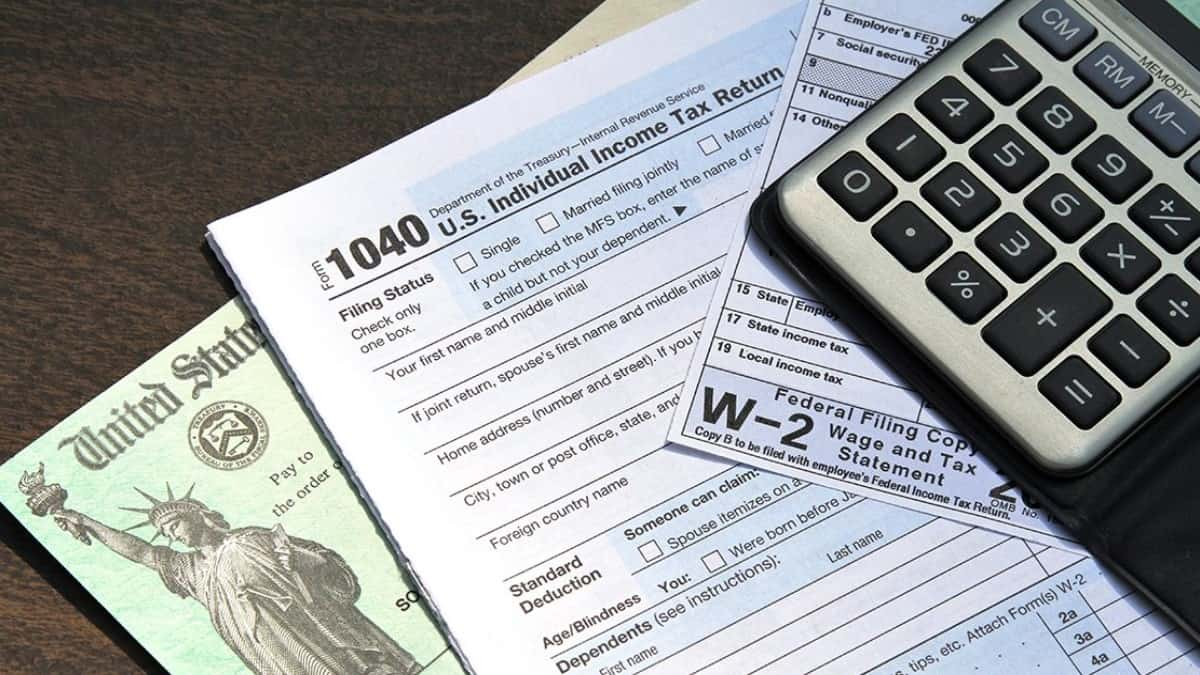

Tax filing information on a W-2

A W-2 form is a tax filing document that contains essential information about an employee’s income. It includes information about wages, taxes, and benefits. Generally, these forms are issued by an employer. However, some individuals receive more than one.

Boxes on a W-2 form are numbered, each serving a specific purpose. The identifiers of the employee and employer appear in these boxes, which can help clarify what the paper is intended to report.

The first box on a W-2 form is titled “Total Income.” In this area, an employer reports the total taxable wages, tips, bonuses, and other compensation for a particular period. An employee’s name and social security number are also written.

The second box on a W-2 form shows the amount of federal income tax that was withheld from an employee’s paycheck during the tax year. This amount may be different from the amount on the tax return. Some forms will also report contributions to a pension or deferred compensation plan and union dues.

It’s an easy to fill out tax form to file that is used by employers to report wage, salary, and tips paid to employees and report the Social Security, Medicare, federal income, state income, and local income taxes withheld from the above income. Employees need their W-2 before the tax season starts so they can file their federal income tax returns on time and properly.

The deadline to file Form W-2 is January 31 of the following year after the tax year ends. For the 2024 tax season – for the income earned in 2023, employers must fill out Form W-2 and furnish their employees with a copy by January 31, 2024.

As an employee who received Form W-2, use the money amounts where necessary such as calculating your gross income on Form 1040 and figuring out total tax payments through income tax withholding. The information reported on Form W-2 is very important and it’s crucial that you enter the amounts as is or make the math accordingly. In a case where the money amounts are entered incorrectly, you may have to amend your federal income tax return to correct the mistakes. This can only result in receiving your refund at a later date than you would. We strongly recommend going over your return a couple of times or use a tax preparation service that you can file for free.