Forms Needed to File Taxes

The federal income tax return isn’t complete without tax forms that must be attached to it. Every taxpayer needs to attach certain tax forms to their federal income tax returns. The tax forms needed to file taxes include the ones that report income and deductions.

Tax forms that report income

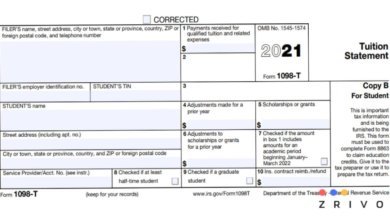

There is a wide range of tax forms that are used for reporting income paid. These tax forms are known as information returns. The most commonly used tax forms that fall in this category are Forms 1099 and Form W-2. If you’re working as an employee to someone, you will get Form W-2 from your employer that reports the total income paid as part of wages during the tax year.

While Form W-2 is furnished to employees, self-employed individuals are most likely to receive Form 1099-MISC or 2024 Form 1099-NEC. There are plenty of other variations of Forms 1099 that report certain income like interests, dividends, unemployment compensation, and more. Learn more about how to add unemployment to taxes.

Tax forms for deductions

When it comes to deductions which are used for reducing taxable income that enables paying less in taxes, there aren’t many tax forms. The two of the most commonly used tax forms for claiming deductions on taxes are Schedule 1 and Schedule A. While you need to itemize deductions in order to claim the deductions on Schedule A, all taxpayers need to use Schedule 1 to figure out their adjusted gross income. Without Schedule 1, taxpayers won’t be able to figure out adjusted gross income which is used for the determination of eligibility for certain tax deductions and credits.

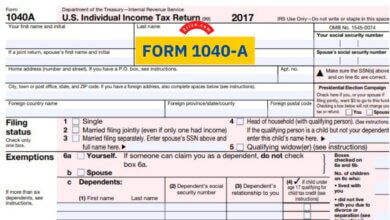

How to attach tax forms to 1040?

Whether or not you need to attach tax forms to your federal income tax return comes down to how you file taxes. If you’re e-filing taxes which is what we recommend, you won’t need to do any sorting of your tax forms. You can simply file on the go and the tax preparation software will take care of these parts of tax filing. For taxpayers who file a paper Form 1040, they need to sort and attach their tax forms to their federal income tax returns themselves. This is easily done by stapling the tax forms on the top right or left corner of Form 1040. If the number of forms is too much to staple, it’s okay not to staple as long as every tax form is in the same envelope. See 1040 instructions for the 2024 tax season.