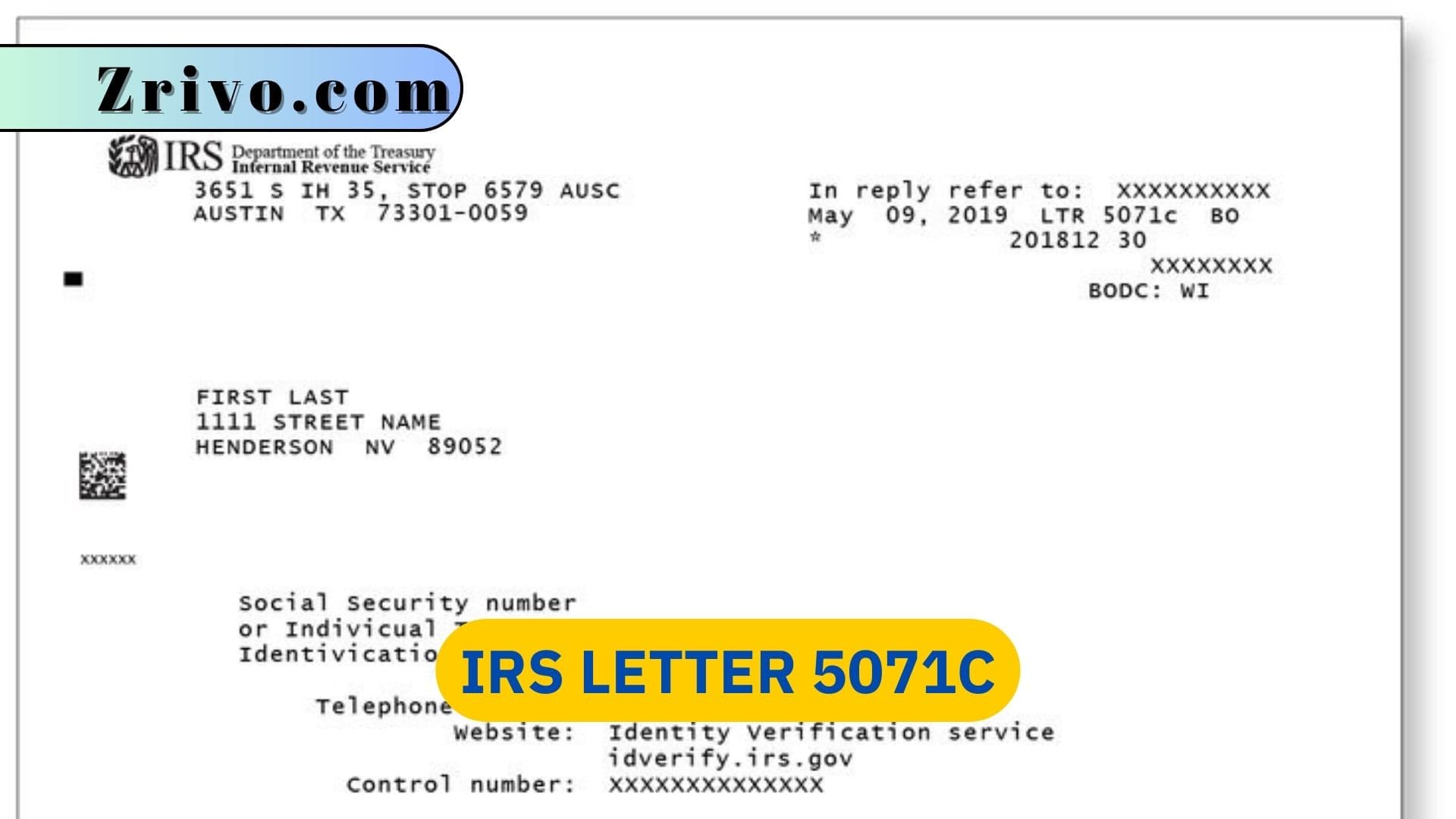

IRS Letter 5071C

When the IRS detects possible identity theft, they send a form asking you to verify your identity online or by phone. This is called an IRS Letter 5071C.

The IRS sends Letter 5071C when it receives a tax return with someone’s name, Social Security number, or Individual Taxpayer Identification Number (ITIN) and suspects that the person is not the true taxpayer. Taxpayers can verify their identity online by calling the number listed on the letter or visiting an IRS office in person to complete the process. The information requested by the IRS varies according to the specifics of each situation, but you will generally be asked to provide proof of your identity and the information from the return you sent. This includes your name, address, date of birth and other relevant information. The IRS is able to use this information to determine whether you filed the return in question and, if necessary, to stop refund fraud.

If you have a 5071C letter and did not file the tax return that was referenced, it is important to contact the IRS immediately. You will need to have a copy of your letter, the tax return in question and supporting documents ready. It is also important to know that even if you did not file the return in question, a fraud alert may have been created for your name, SSN, or ITIN. This can be frustrating and, in some cases, can lead to delays with your tax return processing and refund.

How to Respond to 5071c Letter?

When you receive a letter from the IRS, don’t panic! Despite what the title of the letter might imply, it’s not an audit and doesn’t necessarily signal that you did something wrong. These letters, called Letter 5071C, are part of a program the IRS initiated to combat identity theft and prevent fraudulent refunds. The agency will send this letter when it believes that a return filed in your name may be suspicious for various reasons, such as the information on file doesn’t match what you reported on your W-4. You will be asked to verify your identity using an online service and have the option of contacting an IRS representative over the phone or in person.

Once you’ve verified your identity, the IRS will process your tax return and any refunds or credits due. If you cannot verify your identity, the IRS will not be able to process the return or issue any refunds until they hear back from you. You’ll have 30 days to respond to the identity verification request. Here’s how to respond to a 5071C letter:

Read the Letter Carefully: Take the time to read the letter thoroughly and understand the reason for the verification request. It will provide instructions on how to proceed and may include a unique Identity Verification Number (IVN) you will need during the verification process.

Use the IRS Identity Verification Service: The most common method to verify your identity is to use the IRS Identity Verification Service. This can be done online or over the phone. The letter will provide instructions on how to access the online verification system or the toll-free phone number to call.

Have Required Documents Ready: Gather the necessary documents before initiating the verification process. You’ll typically need your prior year’s tax return, any W-2 or 1099 forms you received, and your Social Security Number (SSN) or Individual Tax Identification Number (ITIN).

Verify Your Identity Online: If you choose the online option, visit the IRS’s identity verification website and enter the requested information, including the IVN, from the letter. Follow the prompts to verify your identity electronically.

Verify Your Identity by Phone: If you prefer the phone option, call the toll-free number in the letter. An IRS representative will guide you through the verification process, which typically includes providing personal and financial information.

Follow Instructions Promptly: The IRS usually provides a deadline for completing the identity verification. Make sure to respond within the given timeframe to avoid any potential delays or issues with your tax return processing.

Be Cautious of Scams: Be vigilant and avoid falling victim to scams. The IRS will not ask for personal information through email, text messages, or social media, such as your SSN or bank account details. Only use official IRS communication channels for verification.

Contact the IRS if Needed: If you encounter any difficulties or have questions during the verification process, don’t hesitate to contact the IRS using the phone number provided in the letter.